How To Invest In Real Estate Abroad A Complete Guide

How To Invest In Real Estate Abroad opens up a world of opportunities for savvy investors looking to expand their horizons. Imagine diversifying your portfolio while exploring new cultures and markets that can enhance your financial future. With the right knowledge and strategies, investing in real estate overseas can be both rewarding and profitable.

This guide will walk you through the essential steps of international real estate investment, including understanding foreign markets, navigating legal complexities, and building local networks. By the end, you’ll be equipped with the tools and insights needed to make informed decisions in your international real estate ventures.

Understanding Real Estate Investment Abroad

Source: vecteezy.com

Investing in real estate abroad opens up a world of opportunities for investors looking to diversify their portfolios and tap into international markets. With globalization, the real estate sector has become increasingly interconnected, allowing individuals to explore investments beyond their local landscapes. This venture can be both rewarding and complex, necessitating a thorough understanding of various factors before diving in.Real estate investment abroad involves purchasing property in a country different from one’s residence, which can range from vacation homes to commercial properties.

This approach not only diversifies one’s investment portfolio but also allows investors to take advantage of emerging markets, potentially higher returns, and different economic cycles. Additionally, it provides the opportunity to generate rental income in currencies that may appreciate against the investor’s home currency.

Benefits of Diversifying a Real Estate Portfolio Internationally

Diversifying a real estate portfolio internationally can shield investors from local market volatility and provide access to new economic opportunities. The following are key advantages of investing in real estate across borders:

- Risk Mitigation: Investing in foreign markets can reduce the impact of economic downturns in the investor’s home country.

- Access to Emerging Markets: Countries with developing economies often offer attractive investment opportunities with potentially high returns.

- Currency Diversification: Holding assets in different currencies can help hedge against currency depreciation.

- Market Opportunities: Certain regions may offer favorable regulatory environments or incentives that enhance real estate investment potential.

- Increased Rental Demand: Properties in popular tourist destinations or growing urban areas may attract higher rental demand, leading to better cash flow.

Key Factors to Consider When Selecting a Country for Investment

Choosing the right country for real estate investment involves careful evaluation of various factors to ensure sustainable returns and manageable risks. Below are crucial elements to consider:

- Economic Stability: A strong and stable economy promotes consistent property value appreciation and rental income. Look for indicators such as GDP growth rates and employment figures.

- Legal and Regulatory Environment: Understanding property laws, taxation, and ownership rights in the target country is vital. Some nations may have stricter regulations for foreign investors.

- Market Trends: Analyze local real estate trends, including supply and demand dynamics, average property prices, and rental yields.

- Political Climate: A stable political environment is essential for protecting investments and ensuring favorable conditions for real estate transactions.

- Cultural Understanding: Familiarity with the local culture can facilitate smoother transactions and better property management.

Researching Foreign Markets

When considering an investment in international real estate, diligent research into foreign markets is crucial. Understanding the local landscape can significantly impact your investment’s success. Knowledge of the economic, political, and social factors influencing the real estate market can help you make informed decisions and mitigate risks.

Researching foreign markets involves a combination of online resources, local insights, and analytical methods. By gathering relevant data, you can assess the viability of investing in a particular region. Below are essential methods and resources for thorough market research.

Methods for Market Research

Utilizing various methods for market research can provide a comprehensive view of potential investment opportunities. Here are some effective strategies to consider:

- Online Marketplaces: Platforms such as Zillow, Realtor.com, and Rightmove offer valuable insights into property listings, pricing trends, and neighborhood statistics in different countries.

- Real Estate Investment Groups: Joining forums and groups on platforms like Facebook or LinkedIn can connect you with local investors who can share their experiences and knowledge.

- Government and Economic Data: National statistics bureaus often provide data related to housing prices, economic growth rates, and unemployment statistics, essential for evaluating market conditions.

- Local Newspapers and Publications: These sources can provide insights into market trends, upcoming developments, and community news that may affect property values.

Online Resources for Market Analysis

Utilizing online resources can greatly enhance your understanding of foreign real estate markets. Several platforms offer market analysis tools and data:

- Statista: A comprehensive statistics portal that provides data on various industries, including real estate, allowing for a deeper understanding of market dynamics.

- International Property Journal: This publication offers insights into international property markets, trends, and investment opportunities worldwide.

- PropertyData: A UK-focused tool that provides insights into property values, buyer demand, and rental yields, helping investors make informed decisions.

- Country-Specific Real Estate Platforms: Websites like Domain (Australia) or LoopNet (USA) provide localized insights and data to analyze specific markets effectively.

The Importance of Local Economic Indicators

Local economic indicators play a vital role in evaluating the potential of real estate investments abroad. Understanding these metrics can help predict future market performance and inform your investment strategy:

- GDP Growth Rates: A rising GDP often correlates with increasing demand for housing and commercial properties in that region.

- Employment Rates: Areas with low unemployment rates generally see more robust real estate demand, as more people are able to afford housing.

- Consumer Confidence Index (CCI): Higher consumer confidence can stimulate housing sales, as individuals feel more secure about making significant investments.

- Infrastructure Development: Ongoing or planned infrastructure projects can enhance property values by improving accessibility and attractiveness of a region.

“Understanding local economic indicators is crucial for making informed real estate investment decisions, as these factors directly influence market behavior and property values.”

Thoroughly researching foreign markets requires diligence and a multifaceted approach, combining local insights with online resources. Understanding economic indicators is key to evaluating the potential of any investment, guiding you toward making informed decisions in the dynamic world of international real estate.

Legal Considerations

Investing in real estate abroad involves navigating a complex landscape of laws and regulations. Understanding the legal aspects of purchasing property in a foreign country is crucial to protect your investment and prevent potential disputes. When considering international real estate investments, it’s essential to familiarize yourself with the specific legal requirements in the target country. Each nation has its own set of rules regarding property ownership, transaction processes, and investor rights.

For instance, some countries may allow foreign buyers to purchase land or properties outright, while others may impose restrictions or require partnerships with local entities. It’s also important to understand the tax implications, including property taxes and any capital gains taxes that may apply upon the sale of the property.

Ownership Laws and Regulations

Ownership laws vary significantly across different countries, often reflecting cultural attitudes towards property rights. In many countries, foreign investors can gain full ownership of residential properties, but commercial properties might require local partnerships. For example:

- Mexico: Foreigners can own property in designated zones, such as tourist areas, but must use a bank trust (fideicomiso) for properties near the coast or borders.

- Spain: There are no restrictions on foreign ownership, and investors can benefit from the Golden Visa program, granting residency for significant investments.

- Thailand: Foreigners can own buildings but not land; however, they can lease land for up to 30 years with options for renewal.

- Germany: Foreign ownership is fully permitted, and the country offers a transparent legal framework for property transactions.

A crucial component of understanding ownership laws is knowing how to navigate property registration processes and local zoning regulations. Always consult with local legal experts to ensure compliance and clarity.

Common Legal Pitfalls

Investing internationally can present unique challenges that may not be apparent at first glance. Being aware of common legal pitfalls can save you time, money, and potential legal troubles. Here are some pitfalls to avoid:

- Neglecting Due Diligence: Failing to research the property’s title, ownership history, and any liens or encumbrances can lead to costly surprises.

- Not Understanding Local Laws: Different countries have varying regulations about property ownership, taxes, and tenant rights, which can impact your investment strategy.

- Overlooking Language Barriers: Misunderstandings can arise from language differences in contracts and legal documents. Always engage a reliable translator if necessary.

- Ignoring Tax Implications: Be aware of both local and home country tax responsibilities related to your investment, including rental income and property taxes.

- Skipping Professional Advice: Attempting to navigate the legal landscape without professional help can expose you to unnecessary risks and complications.

“Understanding the legal landscape is as crucial as choosing the right property.”

Investing in real estate abroad can be rewarding, but it requires careful consideration of the legal framework in your chosen market. Ensuring that you are well-informed and compliant will pave the way for a successful investment journey.

Financing Options

Source: investopedia.com

When it comes to investing in real estate abroad, understanding the financing options available is crucial. Different countries offer varying methods for securing funds, and knowing which one suits your investment strategy can significantly impact your overall success. Here, we will delve into some of the key financing methods you can explore when investing in international real estate.

Foreign Mortgage Options

Obtaining a mortgage in a foreign country can often be a bit more complex than securing one in your home country. Each country has its regulations and requirements for foreign investors. Below are some common types of foreign mortgage options and the requirements typically associated with them:

- Local Banks: Many countries have local banks that offer mortgages to foreign investors. Requirements often include a significant down payment, ranging from 20% to 50%, and proof of income. Some banks might also require a credit history check from your home country.

- International Banks: Some global banks provide financing options for real estate overseas. These banks might have more lenient criteria, but the interest rates could be higher. They usually require documentation of your financial status and proof of investment intention.

- Private Lenders: Private lending can be a flexible option, especially if traditional banks are not accommodating. However, these loans typically come with higher interest rates and may require more substantial collateral.

Understanding these options is vital to navigating the complexities of international real estate financing.

Cash Versus Financing

Deciding whether to pay cash or finance your overseas property purchase can have significant implications. Both options have their pros and cons, and analyzing them can help you make an informed decision.Paying cash can simplify the buying process, particularly in foreign markets where foreign mortgage options may be limited. You can avoid the hassle of loan applications, appraisals, and interest payments.

Additionally, cash offers a competitive edge in negotiations, as sellers often prefer cash buyers for quicker transactions. However, financing can provide you with leverage, allowing you to invest in multiple properties simultaneously without tying up all your capital. Financing also enables you to preserve liquidity for other investments or emergencies. In summary, the choice between cash and financing should align with your overall investment strategy, risk tolerance, and financial goals.

The key is to weigh the immediate benefits against potential long-term gains in your real estate portfolio.

Building a Local Network

Establishing a local network is a crucial step for anyone looking to invest in real estate abroad. The success of your investment often hinges on your ability to connect with knowledgeable local professionals who understand the market dynamics and can guide you through various processes.Building connections with local real estate agents, attorneys, and property managers offers invaluable insights that can help mitigate risks and enhance your investment outcomes.

A well-rounded network can provide you with essential information about neighborhoods, pricing trends, and legal nuances that may differ significantly from your home country.

Importance of Local Connections

Having a strong local network can lead to better investment opportunities and smoother transactions. Here’s why connecting with local professionals is vital:

-

Access to Insider Knowledge:

Local agents and professionals have firsthand experience in their markets, providing insider information that might not be publicly available, such as upcoming developments or shifts in demand.

-

Local Market Expertise:

They understand the nuances of local regulations and can help you navigate any legal hurdles that may arise in your investment journey.

-

Support in Property Management:

If you plan to rent out your property, local property managers can assist in maintaining your investment, handling tenant inquiries, and ensuring compliance with local laws.

Networking Strategies in Foreign Markets

Developing a local network requires a strategic approach. Here are some effective strategies you can implement to build your connections in foreign real estate markets:

-

Attend Local Real Estate Events:

Participate in seminars, workshops, and networking events to meet industry professionals and fellow investors.

-

Join Local Real Estate Groups:

Engage with local real estate associations or online forums that cater to investors. This can help you establish credibility within the community.

-

Utilize Social Media Platforms:

Platforms like LinkedIn and Facebook can connect you with local real estate professionals. Join relevant groups to network and share insights.

-

Hire a Local Consultant:

Consider partnering with a local real estate consultant who can leverage their network to introduce you to potential partners and resources.

Examples of Successful Partnerships

Successful partnerships in real estate can significantly enhance your investment success. Here are a few examples highlighting the advantages of collaboration:

-

Joint Ventures with Local Investors:

Forming a joint venture with a local investor can provide you with shared resources and a deeper understanding of the market.

-

Collaboration with Local Agents:

By collaborating with local agents, you can gain early access to properties and negotiate better deals, leveraging their existing relationships with sellers.

-

Partnerships with Property Managers:

Working with local property management companies can streamline your operations and ensure that your property is effectively marketed and maintained.

Property Management

Investing in real estate abroad presents unique challenges, particularly when it comes to property management. Navigating different regulations, cultural norms, and market dynamics can make overseeing properties from a distance quite complex. This section will delve into the hurdles faced in managing overseas properties and offer insights into effective strategies for ensuring your investments remain profitable and well-maintained.

Challenges of Managing Properties from Abroad

Managing properties from another country can lead to several challenges that investors must be prepared to face. The distance can hinder timely responses to urgent matters, while language barriers and unfamiliarity with local customs may complicate communication. Furthermore, time zone differences can impact decision-making processes and coordination with local vendors.

Ultimately, these factors can affect tenant satisfaction and property upkeep, which are crucial for maintaining steady rental income.

Strategies for Hiring Local Property Management Services

Engaging a competent local property management service is essential for overseas investors. Here are some strategies to ensure you find a reliable partner:

- Conduct Thorough Research: Before selecting a property management company, research their reputation, services offered, and client reviews. Seek recommendations from other investors who have successfully navigated similar markets.

- Assess Local Expertise: Ensure that the property management firm has a deep understanding of the local market, including rental trends, tenant demographics, and legal obligations.

- Evaluate Communication Practices: Opt for a management company that prioritizes transparency and communicates effectively. Regular updates and reports can help you stay informed and engaged with your property’s performance.

- Review Contracts Carefully: Understand the terms and conditions of the management agreement, including fees, responsibilities, and termination clauses, to avoid potential disputes in the future.

Impact of Culture on Property Management Practices

Cultural differences can significantly influence property management practices. Understanding these cultural nuances is vital for effective management and tenant relations. Here are some ways culture can impact property management:

- Communication Styles: Different cultures have varying approaches to communication, which can affect how property managers interact with tenants. For instance, some cultures may favor direct communication, while others may prioritize politeness and indirect methods.

- Tenant Expectations: Cultural backgrounds shape tenants’ expectations regarding maintenance, communication, and overall property management. Recognizing these expectations can help property managers provide better service.

- Compliance with Local Norms: Familiarity with local customs, holidays, and regulations is crucial. For example, certain times of the year may be more favorable for renting or require special considerations during local festivities.

Understanding and adapting to cultural differences can enhance tenant relationships and improve overall property management effectiveness.

Tax Implications

Navigating the tax landscape is crucial for anyone considering investing in real estate abroad. Different countries have varying tax laws, and understanding these can significantly impact your investment’s profitability. This section elaborates on the key tax considerations, including how to handle double taxation and strategies for minimizing your tax liabilities.

Tax Considerations for Owning Real Estate, How To Invest In Real Estate Abroad

Owning real estate in a foreign country can attract a myriad of taxes, which may include property taxes, income taxes on rental income, and capital gains taxes upon selling the property. Each nation has its own tax regulations, which can vary widely. For instance, countries like Australia and Canada impose taxes on rental income at the same rate as regular income, while others may have flat rates for foreign investors.

It’s essential to research and understand the specific tax obligations in your chosen market. Consider the following types of taxes that you may encounter:

- Property Taxes: A yearly tax based on the value of the property, which varies by location.

- Rental Income Tax: Taxes on the money earned through renting out the property, often calculated based on net income after allowable deductions.

- Capital Gains Tax: Taxes due on profits from selling the property, which can differ for residents versus non-residents.

Double Taxation Agreements

Double taxation can become a pressing issue for international investors. This occurs when a person is liable to pay tax on the same income in more than one jurisdiction. Many countries have entered into double taxation agreements (DTAs) to prevent this situation, allowing investors to avoid being taxed twice on the same income.DTAs typically provide methods for allocating taxing rights between countries, which can impact your rental income and any capital gains.

Familiarizing yourself with the DTA between your home country and the foreign country where you’re investing is vital for understanding your tax obligations. Key elements to consider include:

- Tax Credits: Many DTAs allow you to claim tax credits in your home country for taxes paid abroad.

- Exemptions: Certain income types may be exempt from taxation in one of the countries involved in the agreement.

- Withholding Taxes: Some agreements may reduce withholding tax rates on dividends and interest payments, affecting overall investment returns.

Strategies for Minimizing Tax Liabilities

While tax obligations can seem daunting, several strategies can help you minimize tax liabilities on your international investments. By understanding local laws and leveraging available treaties, you can retain more of your profits.Consider the following strategies:

- Utilizing Deductions: Familiarize yourself with deductible expenses related to property management, such as repairs, maintenance, and property management fees, as these can reduce taxable income.

- Choosing the Right Legal Structure: Depending on local laws, setting up a corporation or limited liability company (LLC) to hold the property can provide tax benefits and limit personal liability.

- Consulting Tax Advisors: Engaging with tax professionals who specialize in international investments can provide tailored advice, ensuring compliance while optimizing your tax situation.

Exit Strategies

When investing in real estate abroad, having a well-defined exit strategy is crucial for maximizing returns and minimizing losses. An exit strategy Artikels how an investor plans to divest their investment and retrieve their capital, ensuring they are not caught off-guard by unforeseen market conditions or personal circumstances. Without an exit strategy, investors may find themselves stuck in a poorly performing asset or unable to capitalize on favorable market movements.Understanding various exit strategies can offer investors flexibility and confidence in their international real estate endeavors.

These strategies can vary depending on market conditions, property type, and the investor’s long-term goals. Here are some common exit strategies that investors might consider when investing in international real estate:

Different Exit Strategies

Each exit strategy comes with its own set of advantages and considerations. Here are some of the most popular options:

- Sale of Property: Selling the property outright is the most straightforward exit strategy. Investors can take advantage of favorable market conditions to sell at a profit. For example, if an investor purchased a property in a rapidly developing area, they might choose to sell once the neighborhood has reached its peak appreciation.

- 1031 Exchange: In some jurisdictions, like the U.S., investors can use a 1031 exchange to defer taxes on the sale of a property by reinvesting the proceeds into another similar property. This can be particularly beneficial in international investments where keeping capital working can enhance overall returns.

- Renting Out the Property: If the market is not favorable for selling, an investor might consider renting out the property. This can provide a steady income stream while waiting for market conditions to improve. In some cases, this approach can also increase the property’s value over time as rental demand rises.

- Partnership Buyout: If involved in a partnership, one investor may choose to buy out the other(s). This could simplify the decision-making process and allow for greater control over the investment, especially if the remaining partners have a different vision for the asset.

- Short Sales or Foreclosure: As a last resort, if the property becomes a liability, an investor may opt for a short sale or allow the property to go into foreclosure. This is generally not ideal, but understanding this option is important for risk management.

Market conditions play a significant role in influencing the decision to sell a property. Factors such as economic stability, interest rates, and local demand for real estate can all impact the timing and method of exit. For instance, if there is a downturn in the economy or a spike in interest rates, it may be more advantageous to hold onto the property until conditions improve.

On the contrary, during periods of economic growth or increased foreign investment in a region, it may be wise to capitalize on the opportunity and sell.

“An exit strategy is not just a plan for selling your property; it’s a roadmap to financial success.”

Understanding the dynamics of the market and having a flexible exit strategy can significantly enhance an investor’s ability to make informed decisions and achieve their financial goals in the realm of international real estate.

Final Review: How To Invest In Real Estate Abroad

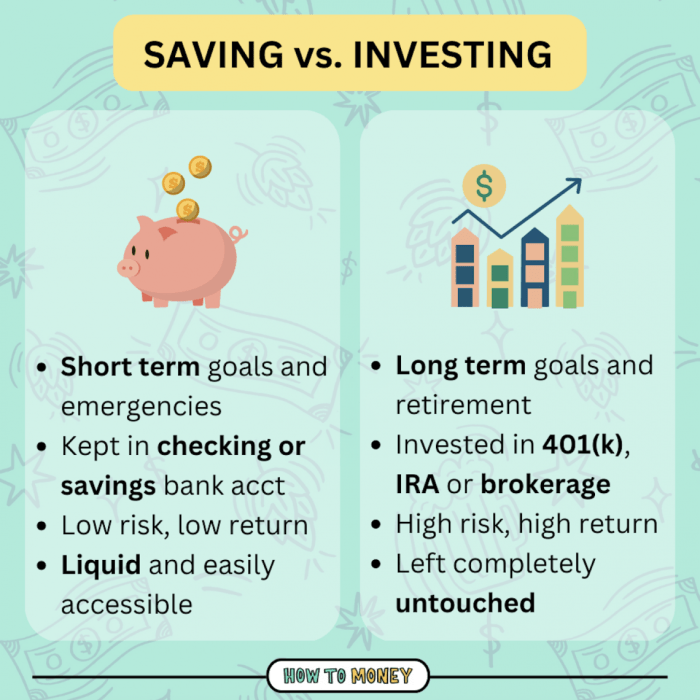

Source: howtomoney.com

In conclusion, investing in real estate abroad is an exciting journey that requires careful planning and consideration. By understanding the market dynamics, legalities, and financial implications, you can position yourself for success in the global real estate arena. As you venture into international investments, remember that knowledge and local connections are your greatest assets.

Quick FAQs

What are the risks of investing in real estate abroad?

Risks include market volatility, legal uncertainties, and cultural differences that may affect property management.

Do I need a local partner to invest overseas?

While not mandatory, having a local partner can provide valuable insights and ease the process of navigating the market.

How can I ensure the property is a good investment?

Conduct thorough research on market trends, property values, and local economic conditions to assess potential investments.

What financing options are available for foreign investments?

Options include foreign mortgages, international banks, and cash purchases, each with its own pros and cons.

Are there tax benefits for owning foreign real estate?

Some countries offer tax incentives for foreign investors, but it’s essential to understand the tax implications in both your home country and the foreign market.