Property Appreciation And Capital Gains Explained

Property Appreciation And Capital Gains sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding how property appreciates over time is crucial for investors and homeowners alike, as it directly affects the potential for substantial capital gains. A variety of factors influence property values, including location, economic conditions, and market trends, making it essential to navigate this landscape carefully.

In the real estate world, property appreciation reflects the increase in property value, driven by both internal and external elements. Capital gains, on the other hand, represent the profit made when a property is sold for more than its purchase price. This interplay between appreciation and capital gains not only shapes investment strategies but also plays a significant role in tax implications for sellers.

Let’s explore the intricate relationship between these two concepts and uncover strategies to maximize returns in the ever-evolving real estate market.

Understanding Property Appreciation

Property appreciation refers to the increase in the market value of a property over time. This concept plays a vital role in real estate as it directly impacts the wealth accumulation potential for property owners and investors. When a property appreciates, it means that its worth has risen, resulting in capital gains when sold. Understanding property appreciation is essential for making informed investment decisions and predicting future market behaviors.Several factors contribute to property appreciation, making it a multifaceted aspect of real estate.

Key elements include the location of the property, prevailing market trends, and broader economic conditions. For instance, properties in prime locations, such as those near schools, parks, and public transportation, typically see higher appreciation rates. Additionally, demand and supply dynamics in the housing market, influenced by interest rates and consumer confidence, also play a significant role. Economic indicators like job growth and population increases further support the likelihood of property value increases.

Factors Contributing to Property Appreciation

Understanding the various factors that influence property appreciation is crucial for both current and future property owners. The following points highlight the essential contributors:

- Location: Properties situated in desirable neighborhoods tend to appreciate faster due to high demand. Proximity to amenities, schools, and transportation can significantly elevate property values.

- Market Trends: Fluctuations in the real estate market, such as buyer interest and inventory levels, dictate property demand. A seller’s market often leads to increased prices, while a buyer’s market may result in stagnation or declines.

- Economic Conditions: Factors like employment rates and consumer spending affect housing demand. Strong economic performance typically correlates with rising property values as more people seek to invest in real estate.

- Property Improvements: Renovations and upgrades made to a property can enhance its value significantly, driving up appreciation rates. Well-maintained properties generally perform better in the market.

- Government Policies: Zoning laws, tax incentives, and development plans can influence property values. Favorable policies often lead to increased investment in an area, consequently boosting appreciation.

Historical trends in property appreciation showcase diverse patterns across various regions. For example, urban areas like San Francisco and New York have experienced significant appreciation over the past few decades, largely due to tech industry growth and limited housing supply. In contrast, certain rural areas may show slower appreciation rates, reflecting less economic activity and demand. According to historical data, the average annual appreciation rate for residential properties in the U.S.

has been around 3-5%, though this can vary widely by region and market conditions.In summary, property appreciation is influenced by a complex interplay of factors. By understanding these dynamics, stakeholders can make more informed decisions that align with their financial goals, whether they are homeowners or investors.

Capital Gains Explained

Source: dialurbanodisha.com

Capital gains are an essential aspect of real estate investment, representing the profit earned from the sale of property. Understanding capital gains helps property owners navigate financial implications associated with their investments. This segment delves into the definitions, classifications, tax implications, and practical examples of capital gains related to property sales.

Definition and Classification of Capital Gains

Capital gains are defined as the increase in the value of an asset or investment over time, compared to its purchase price. In real estate, capital gains occur when you sell your property for more than you paid for it. Capital gains can be classified into two categories: short-term and long-term.

Short-term capital gains refer to profits from the sale of assets held for one year or less. These gains are taxed at the individual’s ordinary income tax rates, which can be significantly higher than the rates for long-term gains. Long-term capital gains apply to assets held for more than one year and are usually taxed at lower rates, making them more favorable for property investors.

Tax Implications of Capital Gains, Property Appreciation And Capital Gains

The tax implications of capital gains can considerably affect net profit from property sales. Here’s a breakdown of how these taxes work:

- Short-term capital gains are taxed at the same rate as regular income. For instance, if an investor sells a property after six months and makes a profit of $50,000, this amount is added to their taxable income, potentially placing them in a higher tax bracket.

- Long-term capital gains are generally taxed at reduced rates, ranging from 0% to 20%, depending on the taxpayer’s income level. For example, if the same investor sells a property after two years for a profit of $50,000, they may only pay a tax rate of 15% on that gain, resulting in a tax liability of $7,500.

“Understanding the tax implications of capital gains can help property investors strategize to minimize their tax burden.”

Calculating Capital Gains in Real Estate Transactions

Calculating capital gains in real estate transactions involves determining the difference between the selling price and the adjusted basis of the property. The adjusted basis includes the original purchase price plus any improvements made to the property, minus any depreciation claimed during ownership. Here’s how it works:

1. Determine the Selling Price

This is the final price for which the property is sold.

2. Calculate the Adjusted Basis

This includes:

Purchase price of the property

Closing costs when purchasing

Cost of improvements made during ownership

Subtract any depreciation taken

3. Calculate Capital Gain

Capital Gain = Selling Price – Adjusted Basis

For example, if a property was bought for $300,000, $20,000 was spent on improvements, and $10,000 was taken as depreciation, the adjusted basis would be $310,

If the property sells for $400,000, the capital gain would be calculated as follows:

Selling Price

$400,000

Adjusted Basis

$310,000

Capital Gain

$400,000 – $310,000 = $90,000

This straightforward calculation helps investors understand their profit and plan their tax strategy accordingly, ensuring they are well-informed about their financial outcomes when selling property.

Relationship Between Property Appreciation and Capital Gains

The relationship between property appreciation and capital gains is fundamental to understanding the dynamics of real estate investments. Property appreciation refers to the increase in the value of real estate over time, while capital gains arise when these properties are sold for a higher price than their purchase cost. The interplay between these two concepts can greatly influence an investor’s profitability and overall investment strategy.Property appreciation directly influences capital gains in real estate investments.

As a property appreciates, its market value increases, leading to potential capital gains when the property is sold. The extent of these gains can vary based on several factors, including the original purchase price, the duration of ownership, and the selling price. For instance, if an investor buys a property for $300,000 and sells it for $450,000, the capital gain would be $150,000, assuming no additional costs are factored in.

This illustrates how appreciation serves as the foundation for capital gains, making understanding market trends and property valuation critical for investors.

Impact of Market Conditions on Appreciation and Capital Gains

Market conditions play a significant role in both property appreciation and capital gains. Various economic factors, such as interest rates, employment rates, and overall economic health, can influence real estate prices. The following points highlight how these conditions affect property values and the resulting capital gains:

- Interest Rates: Lower interest rates often lead to increased borrowing and higher demand for properties, which can drive up prices.

- Economic Growth: In a thriving economy, increased employment opportunities generally enhance consumer confidence, boosting property demand and prices.

- Supply and Demand: A limited housing supply in a desirable area can lead to rapid appreciation, significantly impacting potential capital gains.

- Regional Developments: Infrastructure projects or local amenities can enhance property values in specific neighborhoods, influencing appreciation rates.

Understanding these market dynamics is crucial for real estate investors, as they can identify optimal times for buying or selling properties to maximize their capital gains.

Case Studies of Property Appreciation Resulting in Significant Capital Gains

Analyzing real-life scenarios can provide valuable insights into how property appreciation has led to substantial capital gains. Here are a few noteworthy examples:

1. San Francisco Tech Boom

During the tech boom in the early 2000s, property values in San Francisco skyrocketed due to an influx of tech companies and professionals. Properties purchased in the area for $500,000 in 2000 appreciated to over $1.5 million by 2015, resulting in a capital gain of $1 million for many investors. Austin, Texas Growth: Austin has experienced significant appreciation over the past decade, driven by its growing reputation as a tech hub.

An investor who bought a home for $250,000 in 2010 could see its value exceed $600,000 by 2020, representing a substantial capital gain.

3. Miami Real Estate Surge

Following the 2008 recession, Miami’s real estate market experienced a resurgence. Properties that were valued at $300,000 in 2012 saw a rapid increase, with some selling for over $700,000 by 2020, highlighting how strategic timing in the market can yield impressive capital gains.These case studies illustrate the profound impact of property appreciation on capital gains, emphasizing the need for investors to stay informed about market trends and economic indicators.

Strategies for Maximizing Property Appreciation: Property Appreciation And Capital Gains

Source: co.uk

To enhance property value over time, investors can deploy various strategies that focus on both physical improvements and market-driven actions. Understanding the nuances of property appreciation is vital for maximizing returns on investment. Here, we will explore methods to boost property value, Artikel renovation plans that facilitate appreciation, and provide insights into selecting properties with high appreciation potential.

Methods to Enhance Property Value

Investors can implement several strategies to enhance property value effectively. These methods not only improve the aesthetic appeal and functionality of a property but also increase its market desirability. Here are several key actions investors can take:

- Renovations and Upgrades: Simple upgrades like modernizing kitchens and bathrooms or enhancing curb appeal can significantly boost property value. Research shows that kitchen remodels can yield over a 70% return on investment.

- Energy Efficiency Improvements: Adding energy-efficient windows, insulation, or solar panels can increase a property’s value by making it more attractive to environmentally conscious buyers.

- Landscaping Enhancements: A well-maintained landscape can add an estimated 10% to 20% to the property value, creating a welcoming first impression.

- Utilizing Outdoor Spaces: Transforming patios or backyards into livable spaces can be a vital selling point, especially in urban areas where outdoor space is limited.

Designing a Renovation Plan for Appreciation

Creating a structured renovation plan is essential for ensuring that investments contribute to property appreciation effectively. A well-thought-out plan should be comprehensive and align with current market trends. Consider the following steps:

- Conduct Market Research: Identify popular renovation trends in your area and analyze which upgrades will provide the best ROI.

- Set a Budget: Establish a clear budget to prevent overspending while ensuring that the renovations are high-quality and appealing.

- Prioritize Improvements: Focus on renovations that address critical issues first, such as plumbing or electrical upgrades, before moving on to aesthetic enhancements.

- Engage Professionals: Hire experienced contractors and designers who can deliver quality work and provide insights into cost-effective solutions.

Selecting Properties with High Appreciation Potential

Identifying properties that are likely to appreciate requires a keen understanding of market indicators. Various factors can signal future growth in property values. Here are some key indicators to consider:

- Location Trends: Properties in up-and-coming neighborhoods or those near developing infrastructure, such as new public transport or commercial centers, often see high appreciation.

- School District Quality: Proximity to well-rated schools can enhance property values, as families prioritize educational opportunities.

- Local Economic Conditions: Areas with strong job growth, low unemployment rates, and rising incomes typically experience higher demand for housing, leading to appreciation.

- Historical Data: Review past property value trends in the area to identify patterns that may indicate future appreciation.

Investors should remember that “location is key” when it comes to property appreciation, as it often dictates the demand and desirability of real estate.

Risks Associated with Property Appreciation and Capital Gains

Investing in property can be a lucrative venture, but it comes with its share of risks, particularly related to property appreciation and capital gains. Understanding these risks is essential for investors who want to protect their investments and maximize returns. In this section, we’ll delve into the potential fluctuations in property values, the importance of comprehending capital gains tax obligations, and key market indicators that may suggest a downturn in property values.

Fluctuations in Property Appreciation

Property appreciation can be unpredictable, influenced by various external factors such as economic conditions, interest rates, and local market dynamics. Investors should be aware of the following risks related to fluctuations in property values:

- Market Volatility: Economic downturns, changes in consumer confidence, and shifts in demand can lead to rapid declines in property values.

- Location Risks: Areas that were once desirable can become less attractive due to crime rates, poor infrastructure, or changes in neighborhood demographics.

- Overvaluation: Properties may be overvalued due to speculative buying, leading to sharp declines when the market corrects itself.

Consequences of Ignoring Capital Gains Tax Obligations

Failure to understand and comply with capital gains tax obligations can have significant financial implications for property investors. Not being aware of these obligations can result in unexpected tax liabilities and penalties. Key aspects include:

- Tax Liabilities: Capital gains realized from selling a property are subject to taxes, which can vary based on the holding period and the investor’s income bracket.

- Penalties: Ignoring tax obligations may lead to penalties, including fines or the requirement to pay back taxes with interest.

- Investment Decisions: Lack of awareness regarding capital gains can hinder informed decision-making about when to sell a property for maximum tax efficiency.

Market Indicators of Declining Property Values

Recognizing early signs of a potential decline in property values can help investors make timely decisions. Here are some critical market indicators to monitor:

- Rising Interest Rates: Increased borrowing costs can reduce buyer demand, leading to lower property prices.

- High Inventory Levels: An oversupply of homes on the market often indicates a lack of demand, which can drive prices down.

- Decreasing Home Sales: A consistent decline in sales activity may suggest that buyers are losing confidence in the market.

- Economic Indicators: Unemployment rates, GDP growth, and consumer spending levels directly impact the housing market. Deterioration in these areas often precedes price declines.

Investment Opportunities in Property Appreciation

Investing in real estate can be a lucrative endeavor, particularly when it comes to property appreciation. Understanding where and how to invest is crucial for maximizing returns. The following sections explore emerging markets that show promising trends in property appreciation, alternative property types with their appreciation potentials, and insights on evaluating long-term investment potential based on appreciation forecasts.

Emerging Markets with Promising Property Appreciation Trends

Several markets across the globe are emerging as hotspots for property appreciation. Recognizing these locations can provide investors with strategic opportunities to maximize their returns. Here’s a list of some notable markets:

- Austin, Texas: Known for its thriving tech scene and strong job growth, Austin has seen significant property value increases, making it an attractive option for investors.

- Boise, Idaho: With its stunning natural surroundings and growing population, Boise has become a sought-after location, leading to rapid property appreciation.

- Orlando, Florida: The booming tourism sector and business developments make Orlando’s real estate market one to watch for substantial appreciation.

- Nashville, Tennessee: With a vibrant music scene and a robust economy, Nashville’s property values have soared, making it a prime investment territory.

Alternative Property Types and Their Appreciation Potentials

While residential properties are commonly discussed, alternative real estate types can also present significant appreciation potentials. Understanding these options can diversify investment portfolios.

- Commercial Properties: These include office buildings, retail spaces, and warehouses. Typically, commercial properties yield higher rental income and appreciate faster than residential properties due to long-term leases.

- Industrial Properties: With the rise of e-commerce, industrial spaces such as distribution centers have seen increased demand, leading to notable appreciation.

- Multi-family Units: Properties like apartment complexes can provide consistent cash flow and are often less susceptible to economic downturns, contributing to steady appreciation.

Evaluating Long-term Investment Potential Based on Appreciation Forecasts

When exploring long-term investment potential, it is essential to evaluate various factors that influence property appreciation. Here are some key insights to consider:

- Market Trends: Analyzing historical data on property values and predicting future trends can provide valuable insights into market direction.

- Economic Indicators: Factors such as employment rates, income growth, and population migration patterns are crucial in determining a property’s appreciation potential.

- Infrastructure Developments: Planned developments, such as transportation improvements and new schools, can significantly increase property values in the surrounding areas.

- Neighborhood Dynamics: Understanding the socio-economic changes within neighborhoods, including gentrification or shifts in demographics, can impact appreciation forecasts.

“Investors should remain informed about macroeconomic factors and local market conditions to make informed decisions about property appreciation.”

Closing Summary

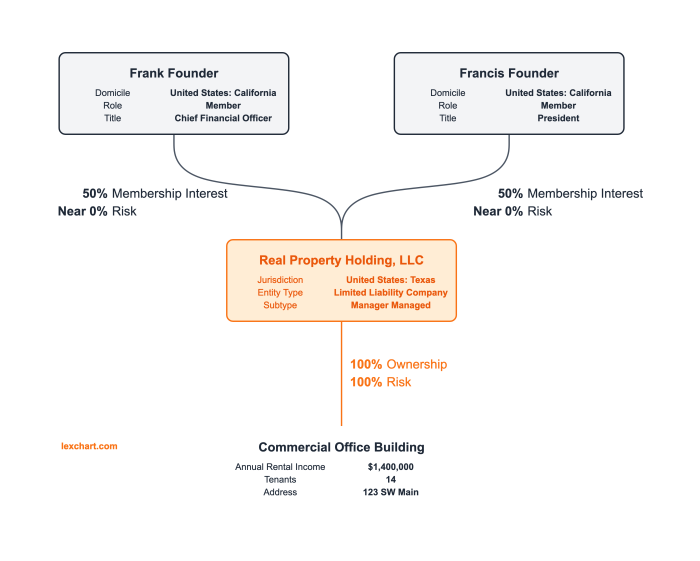

Source: lexchart.com

In summary, understanding Property Appreciation And Capital Gains is vital for anyone looking to invest in real estate or sell their property effectively. By recognizing how appreciation influences capital gains and the factors that drive these changes, investors can make informed decisions that maximize their returns. As we navigate through market trends and potential risks, the strategies discussed will empower you to take charge of your investments and capitalize on the opportunities presented in the dynamic real estate landscape.

Questions and Answers

What is property appreciation?

Property appreciation refers to the increase in the value of real estate over time due to various factors such as location, market demand, and economic conditions.

How are capital gains calculated?

Capital gains are calculated by subtracting the purchase price of the property from its selling price, considering any improvements made and deducting associated costs like fees and taxes.

What are short-term and long-term capital gains?

Short-term capital gains apply to properties held for one year or less, taxed at ordinary income rates, while long-term capital gains apply to properties held for over a year, taxed at reduced rates.

What factors can enhance property appreciation?

Factors that can enhance property appreciation include renovations, improvements in local infrastructure, zoning changes, and overall economic growth in the area.

What risks should investors consider regarding property appreciation?

Investors should consider market fluctuations, economic downturns, and changes in local demand, all of which can impact property values and appreciation rates.