Property Financing Options International Made Simple

Property Financing Options International opens the door to a world of opportunities for investors looking to venture beyond their borders. Navigating through various financing methods can be daunting, but understanding the landscape of international property financing is crucial for making informed decisions. From mortgages to alternative funding sources, the global market offers a variety of choices tailored to diverse needs.

This guide aims to unravel the complexities of securing financing, highlighting the importance of knowing local regulations, examining economic influences, and pinpointing the right strategies for success. Whether you’re an experienced investor or just starting out, this overview will help you grasp the essentials of financing properties internationally.

Understanding Property Financing Options

Property financing involves the various methods and resources available for purchasing real estate, particularly in an international context. As global markets become more interconnected, understanding these financing options is crucial for investors and homeowners alike. The landscape of property financing varies significantly across different countries, influenced by local economic conditions, banking systems, and regulatory frameworks.Understanding the nuances of property financing options globally allows investors to make informed decisions and optimize their investment strategies.

Different countries offer various financing methods, each with its advantages and considerations. Key financing options include traditional mortgages, international loans, and cash purchases, among others. The specific terms, interest rates, and eligibility criteria can differ widely based on local banking practices and laws.

Overview of Financing Options Available Globally

When considering property financing options internationally, it is important to recognize the diverse range of products available. Each option carries unique features that can cater to different investment strategies or personal circumstances. Below are some common financing methods used worldwide:

- Traditional Mortgages: These are the most common financing option, where lenders provide funds in exchange for a security interest in the property. Interest rates can vary based on local economic conditions.

- International Loans: Tailored for non-resident borrowers, these loans enable buyers to finance property in a different country, often coming with specific terms designed for foreign investors.

- Cash Purchases: Buying a property outright with cash removes the need for financing but requires significant capital upfront. This option can offer a competitive edge in negotiations.

- Equity Release: Existing homeowners can access equity in their current property to fund the purchase of another property, allowing for leverage in investment opportunities.

It’s vital to understand the local regulations and laws when pursuing property financing internationally. These regulations dictate the terms of borrowing, ownership rights, and tax implications, which can significantly impact the financial viability of an investment.

Investors should be aware that financing terms can vary drastically across countries, and failing to comprehend local laws can result in unexpected financial liabilities.

Local regulations can also influence the types of financing available. For instance, some countries may have restrictions on foreign ownership or specific requirements for obtaining mortgages as a non-resident. Understanding these legal frameworks is essential for successful international property investments. In summary, navigating the realm of property financing in an international context entails a thorough comprehension of the options available and the regulations governing them.

This knowledge empowers investors to optimize their strategies and minimize risks associated with cross-border real estate transactions.

Types of Property Financing Options

Property financing is a crucial aspect for individuals and businesses looking to invest in real estate. Understanding the different types of property financing options available can help determine the most suitable choice for your needs. From traditional bank loans to alternative financing sources, each option comes with its unique benefits and challenges.

Mortgages

Mortgages are the most common type of financing used for purchasing real estate. They involve borrowing a significant amount of money to buy a property, which is then secured against the property itself. The borrower typically repays the loan in monthly installments over a specified term, usually ranging from 15 to 30 years.

Personal Loans, Property Financing Options International

Personal loans can also be utilized for property financing, particularly for smaller amounts or projects that do not require a mortgage. Unlike mortgages, personal loans are unsecured, meaning they do not require collateral. They generally come with higher interest rates but offer flexibility in terms of repayment periods.

Equity Financing

Equity financing involves raising funds by selling shares in a property or development project. This option is particularly popular among investors looking to fund larger projects without incurring debt. By leveraging equity, investors can share the financial burden and potential profits with co-investors.

Traditional Bank Loans vs. Alternative Financing Sources

When considering property financing, it’s essential to compare traditional bank loans with alternative financing options. Traditional loans are typically more structured and regulated, often offering lower interest rates. However, they can involve a lengthy approval process and strict qualification criteria. In contrast, alternative financing sources, such as peer-to-peer lending or private investors, may provide quicker access to funds with more flexible terms.

However, they often come at a higher cost due to increased risk for the lender. Below is a comparison of key features:

| Feature | Traditional Bank Loans | Alternative Financing |

|---|---|---|

| Interest Rates | Generally lower | Usually higher |

| Approval Process | Lengthy and stringent | Faster and more flexible |

| Collateral Requirement | Property collateral required | Varies |

| Eligibility Criteria | Strict income and credit score checks | More lenient |

Government Programs for International Property Financing

Various government programs can assist individuals and businesses looking to finance property internationally. These programs often provide favorable loan terms, reduced interest rates, or even grants for specific projects. Examples of such programs include:

- FHA Loans: In the United States, the Federal Housing Administration offers loans with lower down payment requirements, making home ownership more accessible.

- USDA Loans: For properties in rural areas, the USDA provides loans with zero down payment options.

- First-Time Homebuyer Programs: Many countries have initiatives that support first-time buyers, offering grants or favorable financing options to ease entry into the property market.

These programs vary by location and eligibility, making it essential to research local resources when considering international property financing.

Factors Influencing Property Financing Decisions

Source: ezylegal.in

Understanding the factors that influence property financing decisions is crucial for investors and homebuyers alike. Various economic variables play a substantial role in shaping one’s financing options, particularly in a global context. A thorough evaluation of these factors can lead to more informed financial decisions and better investment outcomes.One of the primary economic factors affecting property financing options worldwide is the prevailing interest rates.

These rates, influenced by central banks’ monetary policies, dictate the cost of borrowing. When interest rates are low, property financing becomes more affordable, encouraging investments in real estate. Conversely, high interest rates can deter potential buyers or investors, making financing less accessible. Additionally, the overall economic health of a country, reflected in its GDP and employment rates, can further impact property financing options, as stronger economies tend to foster a more favorable lending environment.

Economic Factors Impacting Property Financing

Understanding how various economic factors influence property financing decisions is essential for potential investors. Below are key economic variables that impact property financing options globally:

- Inflation Rates: High inflation can erode purchasing power and increase the cost of living, leading to higher interest rates as lenders seek to compensate for the decreased value of money over time.

- Market Demand: A strong demand for real estate in a specific area can lead to increased property values, influencing the amount of financing available and the terms lenders are willing to offer.

- Global Economic Stability: In times of global economic uncertainty, lenders may tighten their lending criteria, making it more difficult for borrowers to secure financing.

- Government Policies: Tax incentives, regulations, and subsidies can significantly affect the attractiveness of investing in property, influencing financing availability.

Impact of Currency Exchange Rates on International Property Financing

Currency exchange rates also play a significant role in international property financing. Fluctuations in exchange rates can alter the affordability of properties in foreign markets for investors and homebuyers. For example, a stronger home currency can make overseas properties cheaper, while a weaker currency can make foreign investments more expensive.Additionally, cross-border transactions often involve additional costs related to currency conversion and potential fees associated with foreign investments.

Investors must consider these factors when assessing the viability of property financing in different international markets.

“Currency fluctuations can create opportunities or challenges in international property financing, making it essential for investors to stay informed about exchange rate trends.”

Key Considerations for Personal Financial Assessment

Before seeking property financing, individuals should conduct a thorough assessment of their personal financial situation. This evaluation is critical to understanding one’s capacity to meet financing obligations and ensuring sustainable investment. Here are essential considerations to keep in mind:

- Credit Score: A higher credit score often leads to better financing options, including lower interest rates. Understanding one’s credit standing can help in negotiating favorable terms.

- Debt-to-Income Ratio: This ratio compares monthly debt payments to monthly gross income. A lower ratio indicates better financial health and can improve financing prospects.

- Down Payment Savings: Accumulating a substantial down payment can reduce the amount needed to finance and may lead to better loan terms.

- Emergency Fund: Having a financial cushion can provide security and flexibility in case of unexpected expenses, ensuring that mortgage payments remain manageable.

Steps to Secure International Property Financing

Securing international property financing can seem like a daunting task, but with the right approach and understanding of the necessary steps, you can navigate the process with confidence. This guide Artikels the essential steps you need to take in order to successfully secure financing for your international property investment.

Step-by-Step Guide to Applying for International Property Financing

The process of applying for international property financing involves several key steps that require careful planning and attention to detail. Following these steps will help streamline your application and improve the chances of approval.

- Research Financing Options: Begin by exploring the different types of financing options available in the country where you intend to purchase property. Look for local banks, international lenders, or specialized mortgage brokers who operate in the international market.

- Determine Your Budget: Establish a clear budget for your property purchase, taking into account not only the purchase price but also additional costs such as taxes, legal fees, and maintenance expenses.

- Gather Necessary Documentation: Compile all necessary documents required for your application. This typically includes proof of income, tax returns, bank statements, and identification documents.

- Check Your Credit Score: Understand your credit score and financial history as they play a significant role in securing financing. A good credit score can enhance your eligibility for favorable loan terms.

- Apply for Pre-Approval: Submit your application for pre-approval to get an idea of how much financing you can secure. This can give you a competitive edge when making offers on properties.

- Provide Additional Information: Be prepared to answer any questions or provide further documentation as requested by the lender during the evaluation process.

- Finalize the Loan Agreement: Once approved, review the terms of the loan agreement carefully before signing. Ensure that you understand all conditions and obligations associated with the financing.

Necessary Documentation for Securing Financing

Having the right documentation is crucial when applying for international property financing. Each lender may have specific requirements, but the following documents are commonly needed:

“Proper documentation can significantly expedite the financing process and enhance your credibility as a borrower.”

- Proof of Identity: A valid passport or government-issued ID is essential to verify your identity.

- Proof of Income: This may include recent pay stubs, salary letters, or business income statements if you are self-employed.

- Bank Statements: Lenders typically require several months of bank statements to assess your financial health and savings.

- Tax Returns: Providing your tax returns for the last few years helps demonstrate your financial stability.

- Property Details: Information about the property you wish to purchase, including the purchase agreement, valuation report, and title deed, may also be required.

The Role of Credit Scores and Financial History

Credit scores and financial history are vital components of the financing process, influencing both your eligibility for loans and the terms you may receive. A strong credit score indicates a reliable borrower, which can result in lower interest rates and more favorable loan terms. Conversely, a poor credit score may limit your financing options or lead to higher interest rates.

It’s advisable to check and, if necessary, improve your credit score before applying for financing. In many countries, lenders may also consider additional factors such as your debt-to-income ratio and employment history, which can affect their decision-making process. Understanding these elements will assist you in presenting your financial profile in the best light to potential lenders.

Risks and Challenges of International Property Financing: Property Financing Options International

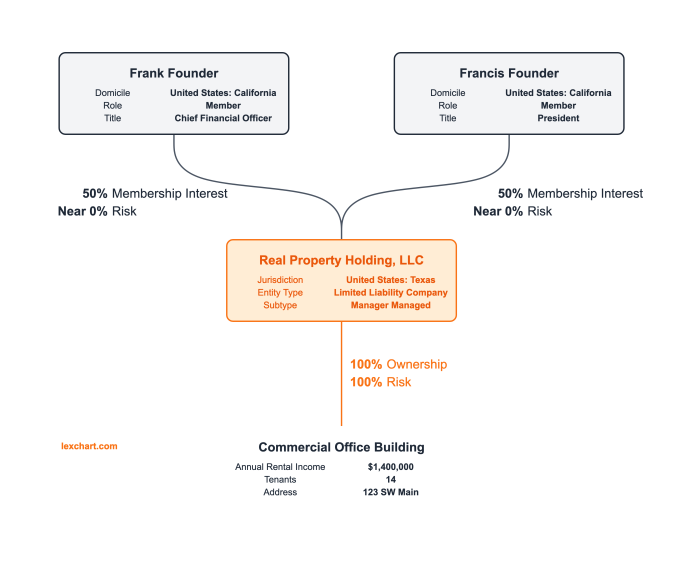

Source: lexchart.com

Investing in international properties can be a rewarding venture, but it comes with its own set of risks and challenges. Understanding these factors is crucial for investors looking to navigate the complexities of property financing in a foreign market. From fluctuating currencies to differing legal systems, several elements can impact the success of your investment.Identifying the potential risks associated with international property investments is essential for making informed decisions.

Factors such as economic instability, fluctuating interest rates, and local market conditions can significantly affect the viability of an investment. Additionally, unfamiliarity with the local legal framework can lead to complications in property ownership and financing.

Potential Risks of International Property Investments

Investors face various risks when financing properties abroad, and it’s important to recognize them early on to mitigate potential losses. The following points Artikel key risks:

- Currency Fluctuations: Exchange rate volatility can impact the value of your investment when converting profits back to your home currency.

- Economic Instability: Political unrest or economic downturns in the foreign market can lead to decreased property values and rental income.

- Legal Issues: Differences in property laws and regulations can result in unexpected legal challenges, including ownership disputes and compliance issues.

- Financing Challenges: Securing financing from a foreign lender can be more complex due to stringent qualifications and different lending practices.

- Market Risks: Local market conditions, such as supply and demand dynamics, can change rapidly, affecting property values and rental rates.

Common Challenges in the Financing Process

Navigating the financing process for international properties can present several challenges that investors must address. Below are common issues that may arise:

- Lack of Local Knowledge: Investors often lack insights into local market conditions, which can hinder their ability to make sound financial decisions.

- Documentation and Paperwork: The financing process may require extensive documentation that can be confusing, especially in a foreign language or legal context.

- Creditworthiness Assessments: Foreign lenders may have different criteria for evaluating creditworthiness, making it difficult for investors to meet financing requirements.

- High Interest Rates: International loans may come with higher interest rates compared to domestic financing options, increasing the overall cost of the investment.

- Transfer of Funds: Sending money internationally can involve high fees and complex regulations that complicate the financing process.

Mitigating Risks in International Property Financing

To successfully finance properties abroad, investors should implement strategies to mitigate associated risks. Here are several approaches to consider:

- Conduct Thorough Research: Understand the local market, economic conditions, and legal requirements before making any investment decisions.

- Engage Local Experts: Collaborate with local real estate agents, legal advisors, and financial professionals who have in-depth knowledge of the market.

- Diversify Investments: Consider spreading investments across multiple properties or regions to reduce the risk associated with any single investment.

- Use Currency Hedging: Explore financial instruments that can protect against currency fluctuations, ensuring a more stable return on investment.

- Review Financing Options: Compare different lenders and financing products to secure the best terms and rates available in the foreign market.

“Understanding the risks and challenges of international property financing is crucial to navigating the complexities of foreign investments effectively.”

Trends in International Property Financing

Source: vecteezy.com

The world of property financing has been evolving rapidly, especially on an international scale. Various factors, including technological advancements, changing economic climates, and consumer preferences, are driving these changes. Understanding these trends is crucial for investors and stakeholders in the real estate market who aim to navigate the intricate landscape of property financing effectively.One of the most significant shifts in international property financing has been the rise of fintech solutions.

These innovative financial technologies are redefining how individuals and businesses approach property financing. Traditional banks and financial institutions have long dominated the property financing sector, but emerging fintech companies are introducing novel solutions that enhance accessibility, efficiency, and user experience.

Rise of Fintech Solutions in Property Financing

Fintech companies are leveraging technology to streamline the property financing process. Their impact can be observed through various dimensions, including speed, accessibility, and transparency. Here are some notable aspects of this trend:

- Speed and Efficiency: Fintech platforms often provide faster loan approvals and streamlined application processes, enabling borrowers to secure financing in days rather than weeks.

- Accessibility: Many fintech solutions cater to underserved markets, allowing individuals with limited credit histories or those in emerging economies to access property financing.

- Data-Driven Decision Making: These companies utilize advanced data analytics to assess borrower risk more accurately, allowing for competitive interest rates and tailored financing solutions.

- Blockchain Technology: Some fintech firms are adopting blockchain to facilitate secure transactions and improve transparency in property deals, reducing fraud and increasing trust among participants.

- Crowdfunding Models: Real estate crowdfunding platforms allow multiple investors to pool their resources for property investments, democratizing access to real estate and reducing the barrier to entry for individual investors.

The contrast between conventional financing methods and the emerging trends can be striking. While traditional banks rely on lengthy processes and strict credit evaluations, fintech solutions offer flexibility and rapid service. Conventional methods generally require significant documentation and face-to-face meetings, whereas fintech platforms often provide digital interfaces that simplify the user experience.

“Fintech solutions not only expedite access to financing but also democratize investment opportunities, allowing a wider range of participants to engage in real estate markets.”

In summary, the trends in international property financing highlight a shift towards digital innovation, improving accessibility and efficiency. As fintech solutions continue to develop, they are likely to reshape the entire landscape of property financing, presenting both new opportunities and challenges for investors and financial institutions alike.

Case Studies in International Property Financing

International property financing offers a myriad of opportunities, but navigating the complexities of foreign markets requires careful consideration and strategic planning. Successful ventures in this realm serve as valuable lessons for prospective investors, while failed attempts highlight the risks involved. This segment will explore several case studies, offering insights into effective financing strategies and the pitfalls to avoid.

Successful International Property Financing Ventures

Highlighting successful cases reveals how investors can thrive despite the challenges. A notable example is the purchase of high-end residential properties in London by Chinese investors. These investors capitalized on favorable exchange rates and rising property values, allowing them to secure long-term profitable returns.

- Case Study: Chinese Investment in London

“Investors utilized their home country’s capital and leveraged favorable loan terms, resulting in significant appreciation of property values within five years.”

The strategic decision to invest in London was driven by its status as a global financial hub, ensuring liquidity and potential for capital growth.

- Case Study: U.S. Investors in European Real Estate

“American investors were able to capitalize on lower property prices in select European cities, driving returns through renovations and subsequent rentals.”

This approach enabled them to navigate international financing by collaborating with local banks that offered competitive rates.

Lessons from Failed Financing Attempts

Understanding the reasons behind failed international property financing can be as enlightening as celebrating successes. A prominent case involves a group of investors who attempted to enter the Brazilian real estate market, only to face significant financial losses.

- Case Study: Brazilian Market Failure

“Lack of local market knowledge and regulatory understanding led to miscalculations that resulted in overvaluation of properties.”

Investors failed to account for the fluctuating currency and evolving political landscape, misguiding their financial strategy.

Comparative Analysis of Financing Strategies

Diverse financing strategies highlight the adaptability required in international property ventures. Different markets necessitate unique approaches, as evidenced by various case studies.

- Debt Financing in Emerging Markets

Investors often resorted to local banks to secure loans, which provided favorable terms but came with higher interest rates due to perceived risks. - Equity Financing in Established Markets

In contrast, established markets like those in North America and Western Europe often relied on equity financing, allowing investors to share the risk and reduce debt burdens. - Partnerships and Joint Ventures

Successful case studies demonstrated that forming alliances with local developers often resulted in better market insights and reduced risks, providing a more comprehensive understanding of the local landscape.

Resources and Tools for Property Financing

Investing in international properties can be a complex endeavor. However, with the right resources and tools, potential investors can navigate this landscape more efficiently. Various online platforms and professional advisors play a crucial role in simplifying the financing process and guiding investors towards informed decisions.

Online Resources for Property Investors

There is a multitude of online platforms that offer valuable information and tools for investors looking to finance international properties. These resources provide insights into market trends, financing options, and property evaluations. Here are some essential resources to consider:

- Mortgage Calculators: Websites like Bankrate and Zillow offer mortgage calculators that help determine monthly payments based on loan amounts, interest rates, and terms.

- Investment Analysis Tools: Platforms such as Roofstock and Mashvisor provide tools for analyzing rental properties, assessing potential returns, and comparing various investment opportunities.

- Real Estate Market Reports: Websites like CBRE and JLL regularly publish market reports that offer insights into property trends and forecasts across different international markets.

- Government Resources: Many countries provide official resources that detail regulations, taxes, and financing options for foreign investors, such as the U.S. Department of Housing and Urban Development.

Importance of Financial Advisors and Consultants

Engaging a financial advisor or consultant can be invaluable when navigating international property financing. These professionals offer expertise that helps investors make informed decisions tailored to their specific needs. Financial advisors assist in evaluating financing options, understanding local regulations, and assessing risk factors associated with investments. Their knowledge of the local market and financial landscape can lead to better financing terms and investment strategies.

Effective Utilization of Financial Calculators

Financial calculators are powerful tools that can demystify the financing process. Utilizing these calculators effectively can provide clarity on potential expenses and returns before making a commitment. Here are some tips for making the most of financial calculators:

- Input Accurate Data: Ensure that you use realistic figures for purchase price, interest rates, and loan terms. Accurate data results in more reliable projections.

- Compare Different Scenarios: Many calculators allow you to adjust variables. Use this feature to see how changes in interest rates or loan amounts affect your monthly payments and overall investment cost.

- Understand the Outputs: Familiarize yourself with key outputs like total interest paid, amortization schedules, and break-even points to gain comprehensive insights into your financing options.

- Combine with Other Tools: Use calculators in conjunction with market analysis tools to get a broader view of your investment’s financial viability.

Utilizing the right resources and engaging with professionals can significantly enhance your property financing journey, making it smoother and more informed.

Last Word

In conclusion, understanding Property Financing Options International is key to unlocking the potential of global real estate investments. By exploring various financing methods, recognizing potential risks, and staying updated on market trends, investors can make well-informed choices. With the right tools and resources, the journey into international property financing can be both rewarding and successful.

FAQ Section

What are the common types of property financing available internationally?

Common types include mortgages, personal loans, and equity financing, along with government programs designed for foreign investors.

How does currency exchange affect international property financing?

Currency exchange rates can significantly impact the cost of financing and the overall investment return for properties purchased in foreign currencies.

What documents are typically required for securing international property financing?

Required documents usually include proof of income, credit history, property details, and legal identification, among others.

Are there specific risks associated with international property investments?

Yes, risks include fluctuating currency values, differing legal frameworks, and potential political instability in the investment location.

How can I mitigate risks when financing properties abroad?

Conduct thorough research, work with local experts, and consider insurance options to protect your investment.