Property Insurance For Investment Properties Explained

Property Insurance For Investment Properties is essential for safeguarding your valuable assets in the real estate market. As an investor, it’s crucial to understand the various risks that can threaten your property, from natural disasters to tenant-related issues. With the right insurance policy, you can protect your investments and ensure peace of mind as you navigate the complexities of property management.

This overview will delve into the significance of property insurance, exploring different policy types, factors influencing costs, and tips for selecting the best coverage. Whether you’re new to property investment or looking to refine your insurance strategy, understanding these components can significantly impact your financial success.

Importance of Property Insurance for Investment Properties

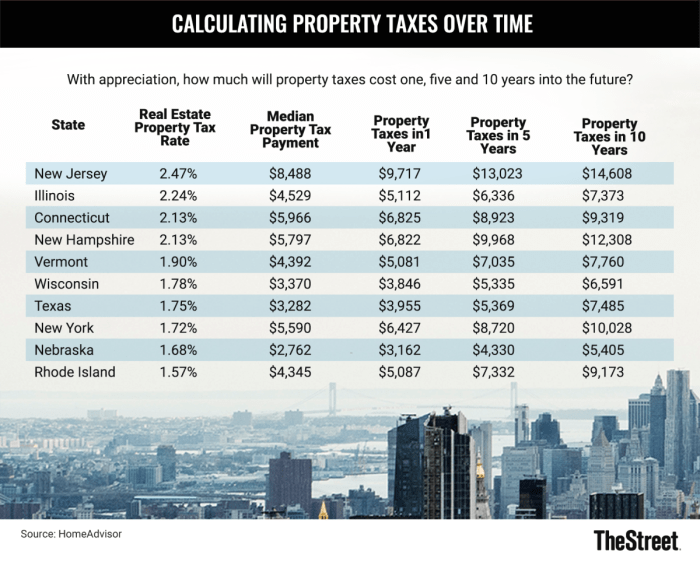

Source: thestreet.com

Investing in properties can yield substantial financial rewards, but it also comes with its fair share of risks. Property insurance is a vital component of any investment strategy, offering a safety net that protects your assets from unforeseen events. Understanding the importance of property insurance can help investors secure their investments and ensure long-term financial success.Property insurance plays a crucial role in safeguarding investment assets by covering various risks that can lead to financial losses.

These risks include natural disasters such as floods, earthquakes, and storms, as well as man-made incidents like vandalism and theft. By having adequate insurance coverage, property investors can mitigate these risks and protect their capital. For instance, if a rental property suffers significant damage due to a fire, property insurance can cover the repair costs, preventing the investor from bearing the entire financial burden.

Common Risks Faced by Investment Properties

Investment properties are vulnerable to a range of risks that can impact their value and the investor’s financial stability. It’s essential to identify these risks to understand the necessity of having property insurance.

- Natural Disasters: Events like hurricanes, earthquakes, and floods can cause catastrophic damage to properties, leading to costly repairs or even total loss.

- Vandalism and Theft: Unoccupied properties can attract vandalism or theft, resulting in unexpected repair costs and reduced value.

- Liability Claims: Injuries occurring on the property can lead to expensive liability claims, making it vital for property owners to have insurance that covers legal fees and settlements.

- Market Fluctuations: Economic downturns can affect property values, and while insurance can’t prevent this, it does protect against loss due to physical damage.

Investors should prioritize property insurance for several key reasons, ensuring that their investments remain secure and financially viable.

- Financial Protection: Insurance provides a financial safety net that can cover significant repair costs, keeping cash flow stable.

- Peace of Mind: Knowing that your investment is protected allows investors to focus on growth and management without worrying about potential losses.

- Legal Compliance: Many lenders require insurance coverage as a condition of financing, making it essential for securing loans.

- Asset Value Preservation: Insurance helps maintain the property’s value by providing funds for restoration and repairs after damage occurs.

“Investing in property without insurance is like sailing without a life jacket; the risks are too great to navigate without proper protection.”

Types of Property Insurance for Investment Properties

Investors in real estate must navigate various insurance options to protect their assets effectively. Understanding the different types of property insurance available is crucial for safeguarding investment properties against potential risks and liabilities. This section delves into the key types of property insurance policies, highlighting their distinctions and specialized options tailored for specific property types.

Dwelling Coverage and Liability Coverage

Dwelling coverage and liability coverage serve distinct purposes in property insurance. Investors should be aware of these differences to select the right coverage for their properties. Dwelling coverage protects the physical structure of the property against risks such as fire, theft, or vandalism. This type of insurance typically covers the costs of repairing or rebuilding the property in the event of a covered loss.

It’s essential for investors to assess the replacement cost of their property to ensure they have adequate coverage.In contrast, liability coverage provides protection in case someone is injured on the property or if the property causes damage to someone else’s property. This coverage is vital for investors as it can help cover legal costs and settlements, shielding their personal assets from potential lawsuits.

Both types of coverage are essential; while dwelling coverage focuses on protecting the property itself, liability coverage addresses the investor’s responsibility towards others.

Specialized Insurance Options for Various Property Types

Different property types often require specialized insurance products to address unique risks and challenges. Here are some examples of specialized insurance options available for specific property types:

- Multi-Family Properties: Investors owning duplexes, triplexes, or larger apartment complexes should consider multi-family property insurance. This policy typically combines dwelling and liability coverage and may include provisions for loss of rental income due to property damage.

- Commercial Properties: For those investing in commercial real estate, such as office buildings or retail spaces, commercial property insurance is essential. This policy covers the building, equipment, and inventory against risks like fire, theft, and natural disasters. Additional liability coverage is often necessary to protect against potential lawsuits.

- Vacant Properties: Properties that are unoccupied for extended periods may require vacant property insurance. Standard homeowner policies usually do not cover vacant homes, so specialized coverage is crucial to protect against risks like vandalism and weather-related damage.

- Short-Term Rental Properties: Investors renting properties on platforms like Airbnb should consider short-term rental insurance. This coverage can provide protection against damages caused by guests and loss of income due to cancellations or property issues.

Each of these specialized options is designed to cater to the unique needs and risks associated with different types of investment properties, ensuring investors can protect their valuable assets effectively.

“Understanding the nuances of dwelling and liability coverage can significantly impact an investor’s financial security.”

Factors Influencing Property Insurance Costs: Property Insurance For Investment Properties

Determining the cost of property insurance for investment properties involves a myriad of factors that can significantly affect premiums. It’s essential to understand these elements to better manage risks and costs associated with investment properties. Various aspects, including property details and geographical location, play crucial roles in shaping insurance rates.The location of a property can have a profound impact on insurance rates and the type of coverage available.

Properties situated in areas prone to natural disasters, such as floods or earthquakes, typically face higher premiums due to the increased risk. Furthermore, local crime rates can also influence insurance costs; higher crime rates often lead to increased premiums as insurers account for greater potential losses.Several factors contribute to how much you’ll pay for property insurance, and recognizing these elements can help property owners make informed decisions.

Here’s a closer look at some common factors that influence property insurance costs:

Common Factors Affecting Insurance Premiums

Understanding the elements that contribute to insurance costs can empower property owners to optimize their coverage and expenses. The following factors are essential in determining insurance premiums:

- Property Age: Newer properties often receive lower premiums since they are less likely to have issues that can lead to claims.

- Property Size: Larger properties may incur higher insurance costs due to their increased replacement value.

- Occupancy Type: Properties used for rental income may face different rates compared to owner-occupied homes, with investment properties generally incurring higher premiums.

- Location: Areas with a history of natural disasters or high crime rates can lead to increased insurance premiums.

- Construction Type: The materials used in construction (brick, wood, etc.) influence fire and hazard risks, thus affecting costs.

- Safety Features: Properties equipped with security systems, smoke detectors, and fire alarms may benefit from lower premiums.

- Claims History: A history of claims on the property can lead to higher premiums as insurers see a higher risk of future claims.

Understanding these factors helps in making informed choices about property management and insurance coverage, ensuring that property owners can mitigate risks effectively while managing costs.

Choosing the Right Property Insurance Provider

Selecting the right property insurance provider is crucial for protecting your investment properties. With numerous options available, it’s essential to evaluate various insurers based on their offerings, reputation, and reliability. A well-informed choice can save you from potential headaches down the line.When comparing different insurance providers, focus on three key aspects: coverage options, customer service, and claims processes. Each insurer has distinct offerings that may suit your specific needs differently, so it’s wise to investigate thoroughly.

Additionally, understanding how well an insurance company handles claims can significantly impact your experience when you need to file one.

Evaluating Insurer’s Reputation and Financial Stability

Understanding an insurer’s reputation and financial stability is vital for making an informed decision. A provider with a strong financial background is more likely to fulfill claims when necessary. Here are some tips for evaluating an insurer:

Research Online Reviews

Check platforms like Google Reviews or Trustpilot to gauge customer satisfaction and common experiences.

Consult Rating Agencies

Assess ratings from agencies like A.M. Best or Moody’s, which provide insights into an insurer’s financial stability and claims-paying ability.

Ask for Recommendations

Talk to other property investors or real estate professionals to gain firsthand knowledge of good insurance providers.

Comparative Analysis of Top Insurance Providers

To make your decision easier, here’s a table comparing key features of some top insurance providers for investment properties. This table Artikels coverage options, customer satisfaction ratings, and claims handling processes.

| Insurance Provider | Coverage Options | Customer Service Rating | Claims Process Efficiency |

|---|---|---|---|

| Provider A | Comprehensive, liability, rental loss | 4.5/5 | Fast (Average 5 days) |

| Provider B | Basic, extended coverage, theft | 4.0/5 | Moderate (Average 10 days) |

| Provider C | Specialized policies, flood, fire | 4.8/5 | Very Fast (Average 3 days) |

| Provider D | Standard, high-value, umbrella | 4.2/5 | Slow (Average 15 days) |

Choosing the right insurance provider involves more than just selecting the lowest premium. It requires a careful examination of their offerings, reputation, and how quickly they can assist you during a claim. This structured approach will help ensure that your investment properties are properly protected, giving you peace of mind.

The Claims Process for Property Insurance

When it comes to property insurance for investment properties, understanding the claims process is crucial. An efficient claims process ensures that you can recover losses and repair damages without prolonged financial strain. Knowing the steps involved can streamline the experience and alleviate some of the stress that often accompanies property damage.The process of filing a claim for property insurance typically involves several key steps.

From the initial reporting of damage to the final settlement, each phase is important for ensuring that your claim is processed accurately and promptly. Being diligent and organized is essential in this process to avoid any potential pitfalls that could delay your compensation.

Steps Involved in Filing a Claim

Understanding the steps to file a claim helps in navigating the often complex claims process. Each stage should be approached methodically to ensure all necessary information is submitted correctly. Below are the steps typically involved:

- Report the Damage: Notify your insurance provider as soon as possible. Provide them with essential details about the incident.

- Document the Damage: Take pictures and videos of the affected areas. This documentation serves as evidence for your claim.

- Fill Out Claim Forms: Complete the necessary claim forms provided by your insurer. Ensure all information is accurate and complete.

- Submit Additional Documentation: Depending on your policy, you may need to submit estimates, receipts, or other paperwork related to the loss.

- Meet with the Adjuster: An insurance adjuster will assess the damage. Be prepared to answer questions and provide further documentation if requested.

- Receive a Claim Decision: After the review, the insurer will provide a claim decision. If approved, they will Artikel the compensation you will receive.

- Resolve Any Issues: If your claim is denied or if the offered amount is unsatisfactory, you can appeal the decision or negotiate with your insurer.

Best Practices for Documenting Damage

Thorough documentation of damage is a vital part of the claims process. By effectively documenting loss, you can facilitate a smoother claims experience. Employ these best practices to ensure your documentation is comprehensive:

“Proper documentation can significantly impact the outcome of your claim.”

- Take Clear Photos: Capture various angles of the damage. Ensure the lighting is good, and include close-ups of significant issues.

- Keep a Detailed Journal: Write down the timeline of events, describing how and when the damage occurred.

- Collect Estimates: Get repair estimates from licensed contractors. This provides your insurer with a clear understanding of the potential costs involved.

- Maintain Communication Records: Document all conversations with your insurance provider, including dates, times, and the names of representatives.

- Store Important Documents Safely: Keep copies of your insurance policy, correspondence, and any relevant documents organized and accessible.

Checklist for Filing a Claim

Having a checklist can help ensure you are fully prepared to file your claim. Below is a detailed checklist of items to prepare when filing a claim:

- Insurance Policy Number: Have your policy number readily available for quick reference.

- Claim Forms: Complete all necessary forms as Artikeld by your insurance company.

- Damage Documentation: Include photographs, videos, and written descriptions of the damage.

- Repair Estimates: Gather estimates from at least two contractors to support your claim.

- Receipts and Invoices: Keep any receipts related to repairs or temporary accommodations.

- Personal Identification: Have your identification and any necessary ownership documents ready.

- Contact Information for Witnesses: If applicable, include contact details of anyone who witnessed the damage.

- Ongoing Communication Records: Maintain a log of all interactions with your insurance representative.

Common Exclusions in Property Insurance Policies

In the realm of property insurance for investment properties, it’s crucial to recognize that not all potential risks are covered under a standard policy. Exclusions can leave property owners vulnerable to unforeseen circumstances that may lead to significant financial losses. Understanding these exclusions enables property investors to make informed decisions regarding their coverage needs.Many insurance policies come with specific exclusions that directly impact the level of protection for investment properties.

These exclusions can vary between policies and providers but generally encompass several common scenarios. Being aware of these exclusions is key for landlords and real estate investors who seek to protect their assets effectively.

Typical Exclusions in Property Insurance Policies

Understanding the typical exclusions found in property insurance policies helps property investors anticipate potential gaps in coverage. These exclusions may include the following:

- Flood Damage: Most standard policies do not cover damage from flooding. Property owners in flood-prone areas may need to secure separate flood insurance to mitigate this risk.

- Earthquake Damage: Similar to flood coverage, earthquake damage is often excluded. Consider purchasing a separate earthquake policy, especially in seismically active regions.

- Wear and Tear: Policies typically do not cover damage resulting from normal wear and tear or maintenance issues. Regular upkeep is essential to prevent these losses.

- Pest Infestation: Damage caused by pests, such as termites, is usually not covered under property insurance. Landlords should implement preventive measures and inspections.

- Negligence: If a property owner is found negligent in maintaining the property, any resulting damage might not be covered. Adhering to safety regulations and maintenance standards is critical.

The implications of these exclusions can be significant, leading to unexpected costs that may arise from incidents that are not covered. For instance, a property located in a flood zone that suffers damage during a storm without flood insurance can result in substantial out-of-pocket expenses.

Mitigation of Risks Related to Common Exclusions

Addressing these exclusions is essential for comprehensive risk management. Property investors can take several proactive steps to mitigate risks associated with common exclusions in their policies:

- Purchase Additional Coverage: Consider adding endorsements or separate policies for flood and earthquake coverage, especially if the investment property is located in a high-risk area.

- Regular Maintenance: Implement a routine maintenance schedule to address wear and tear proactively. This minimizes the risk of damage that may not be covered.

- Pest Control: Engage professional pest control services to prevent infestations. Documenting these efforts can also support claims if an issue arises.

- Understand Local Risks: Research the specific risks associated with the property location. This knowledge will inform decisions regarding additional coverage needed for environmental hazards.

By taking these measures, property investors can enhance their protection against potential losses linked to exclusions in their insurance policies. Investing time and resources into understanding and addressing these gaps is paramount for maintaining a profitable investment portfolio.

Legal Considerations Related to Property Insurance

Understanding the legal implications of property insurance is crucial for property owners, especially those investing in rental properties. Property insurance is not just a safety net; it also fulfills legal obligations that can impact ownership rights and financial responsibilities. Adhering to state-specific regulations and mortgage requirements ensures that property owners are adequately protected and compliant with the law.Legal obligations of property owners concerning insurance coverage vary by jurisdiction and specific investment arrangements.

It is essential for property owners to be aware of these obligations to protect their investments and adhere to legal standards. Some of the key legal considerations include:

Legal Obligations of Property Owners

A comprehensive understanding of the legal responsibilities concerning property insurance includes the following aspects:

- Insurance Requirement in Mortgage Agreements: Many mortgage lenders mandate specific insurance coverage to protect their investment. Failure to maintain such coverage can lead to penalties or even foreclosure.

- Landlord Liability: Property owners are legally responsible for maintaining a safe environment for tenants. Adequate insurance coverage helps safeguard against potential lawsuits arising from injuries or damages occurring on the property.

- State Regulations: Each state has its own set of regulations governing property insurance, which can impact the required coverage and claims processes. It’s imperative to be informed about these laws to remain compliant and avoid legal complications.

Understanding state-specific regulations is vital, as these laws can dictate the minimum coverage requirements and the procedures for filing claims. These regulations often protect both property owners and tenants by ensuring adequate financial backing in case of damages or losses.

Importance of Maintaining Adequate Coverage

Maintaining sufficient property insurance coverage is critical not only for financial security but also for compliance with legal and contractual obligations. The following points highlight the significance of adequate coverage:

- Compliance with Leasing Agreements: Many lease agreements require that landlords maintain adequate liability and property insurance, ensuring that tenants’ rights and property are protected.

- Protecting Against Financial Loss: In the event of damages, whether due to natural disasters or man-made incidents, adequate insurance coverage can prevent significant financial setbacks that could otherwise jeopardize the property owner’s investment.

- Peace of Mind: Knowing that there is sufficient coverage in place can provide property owners with peace of mind, allowing them to focus on managing their investments without the constant worry of potential liabilities.

In summary, the legal considerations surrounding property insurance for investment properties extend beyond basic coverage needs. By understanding the obligations and regulatory requirements unique to their state and ensuring adequate coverage, property owners can protect their investments and mitigate potential legal issues.

Tips for Reducing Insurance Premiums

Investing in property insurance is crucial for protecting your investment properties, but managing costs without sacrificing coverage is equally important. Fortunately, there are several strategies you can implement to effectively reduce your insurance premiums while maintaining adequate protection against potential risks.One of the most effective ways to lower your insurance premiums is to bundle multiple insurance policies with a single provider.

Many insurance companies offer discounts to policyholders who choose to consolidate their coverage. This not only simplifies your insurance management but can also lead to significant savings.

Common Discounts Offered by Insurance Companies

Understanding the various discounts available can help you maximize your savings on property insurance. Here’s a list of common discounts that might apply to your investment properties:

- Multi-Policy Discount: A discount for bundling home, auto, or other insurance policies together.

- Claim-Free Discount: A reduction in rates for policyholders who haven’t filed any claims for a specified period.

- Security Features Discount: Savings for having security systems, smoke detectors, or fire alarms installed in your properties.

- New Property Discount: A discount for insuring newly built or recently renovated properties.

- Association Discount: Discounts for being part of certain professional or homeowner associations.

- Landlord Insurance Discount: Specialized discounts for landlords with multiple rental properties.

- Payment Method Discount: Savings for opting for annual payment instead of monthly installments.

By leveraging these discounts, you can significantly lower your premium costs while ensuring that your properties remain adequately insured. Furthermore, regular policy reviews and maintaining a good credit score can also contribute to lower insurance rates, adding to your overall savings strategy.

Future Trends in Property Insurance

Source: inspiringmeme.com

The property insurance landscape for investment properties is evolving rapidly due to various emerging trends. Investors and property owners must stay informed about these changes to make the best decisions for their asset protection. As we look ahead, several key trends are reshaping the insurance industry, particularly in relation to technology and climate change.

Emerging Trends Impacting Property Insurance, Property Insurance For Investment Properties

Several trends are currently influencing the property insurance sector, fundamentally altering how policies are structured and sold. These trends reflect broader changes in consumer behavior, regulatory environments, and the increasing importance of technological advancements.

- Digital Transformation: The shift towards digital platforms is making it easier for property owners to compare policies, understand coverage details, and purchase insurance online. This trend is driven by the demand for convenience and transparency in the insurance market.

- Personalization of Policies: Insurers are beginning to offer customizable policies that allow property owners to select specific coverage options tailored to their unique needs, rather than opting for one-size-fits-all solutions.

- Increased Use of AI and Data Analytics: The integration of artificial intelligence and big data is enabling insurers to assess risks more accurately, set premiums more effectively, and streamline claims processes. AI tools can analyze historical data to predict future risks, leading to more informed underwriting decisions.

- Focus on Cybersecurity Insurance: With more investment properties becoming dependent on smart technologies, there is a growing need for cybersecurity insurance to protect against data breaches and cyber threats that could impact property management systems.

Impact of Technology on the Insurance Industry

The insurance industry is undergoing significant transformation due to technological advancements, particularly through the use of AI and data analytics. These tools are revolutionizing how insurers assess risks and interact with clients.

- Risk Assessment: Advanced algorithms analyze vast amounts of data, including historical claims, geographic information, and socioeconomic factors, to provide a more accurate risk profile for each property. This leads to fairer pricing and improved policy offerings.

- Claims Processing: Technology streamlines the claims process, allowing for quicker response times and enhanced customer satisfaction. Automated systems can evaluate claims based on predefined criteria, reducing the time it takes to process claims significantly.

- Telematics: The use of telematics in property management allows for real-time monitoring of properties. Sensors can detect issues such as water leaks or fire hazards early, potentially reducing claims and minimizing property damage.

Influence of Climate Change on Insurance Policies

Climate change is emerging as a pivotal factor that may reshape property insurance coverage options. With increasing frequency and severity of natural disasters, insurers are adapting their policies to mitigate risks linked to environmental changes.

- Increased Premiums for High-Risk Areas: Properties located in regions prone to extreme weather events, such as hurricanes or floods, may face higher premiums or even difficulty obtaining insurance altogether.

- Enhanced Coverage Options: Insurers may start offering specialized policies that cover specific climate-related risks, such as flood insurance, earthquake coverage, or wildfire protection, reflecting the growing need for comprehensive risk management.

- Incentives for Sustainable Practices: Some insurers are beginning to offer discounts for properties that implement green building practices or utilize sustainable materials, as these measures can reduce long-term risk and environmental impact.

Epilogue

Source: hindustanproperty.com

In summary, navigating the world of Property Insurance For Investment Properties is not just about compliance; it’s about building a solid foundation for your investment strategy. By selecting the right coverage, understanding potential risks, and staying informed about industry trends, you can protect your assets effectively and enhance your investment’s resilience. Ultimately, investing time in this knowledge will pay off, ensuring that your properties are secured for the future.

Commonly Asked Questions

What is the purpose of property insurance?

Property insurance protects your investment against damages and liability, ensuring financial stability in the event of unforeseen incidents.

How can I lower my property insurance premiums?

You can lower your premiums by bundling policies, increasing deductibles, and maintaining a good credit score.

Do I need property insurance if my property is vacant?

Yes, even vacant properties should have insurance to protect against risks like vandalism and natural disasters.

What factors affect the cost of property insurance?

Factors include location, property age, size, occupancy, and the coverage amount you choose.

Can I customize my property insurance policy?

Yes, many insurers offer customizable policies that allow you to add specific coverage based on your property’s needs.