Real Estate Due Diligence Checklist Essential Guide

Real Estate Due Diligence Checklist is your essential roadmap for navigating the complexities of real estate transactions. Whether you’re a seasoned investor or a first-time buyer, understanding the intricacies of due diligence can save you from costly mistakes and ensure wise investment choices. This checklist will help you identify critical areas to focus on, thereby elevating your confidence in making informed decisions.

By breaking down the due diligence process into manageable components such as legal, financial, and physical assessments, this guide equips you with the knowledge needed to mitigate risks and enhance your portfolio’s performance. Through thorough analysis and investigation, you can uncover hidden challenges and opportunities that might otherwise go unnoticed.

Importance of Real Estate Due Diligence

Conducting due diligence in real estate transactions is a critical step for investors, buyers, and sellers alike. It involves a comprehensive evaluation of a property to uncover any potential issues that could affect its value, legality, or desirability. Skipping this vital process can lead to severe financial consequences and lost opportunities.The significance of due diligence cannot be overstated. It serves as a safeguard against risks that are often hidden beneath the surface of property ownership.

For instance, failing to investigate the zoning laws may result in buying a property that cannot be used for the intended purpose. Similarly, overlooking structural issues or title defects can lead to substantial renovation costs or legal disputes. Therefore, thorough due diligence supports informed decision-making and contributes to the overall health of an investment portfolio.

Potential Risks of Neglecting Due Diligence

Understanding the risks associated with neglecting due diligence helps to emphasize its importance. The following points illustrate potential pitfalls:

- Financial Losses: Without proper evaluation, investors might unknowingly purchase properties with significant repair needs, leading to unexpected expenses.

- Legal Complications: Overlooking title issues can result in ownership disputes or encumbrances, which can delay transactions and incur legal fees.

- Regulatory Non-compliance: Properties may not meet local regulations or zoning laws, jeopardizing their intended use and leading to fines or mandated changes.

- Market Value Discrepancies: Failing to assess neighborhood trends or future developments may lead to overpaying for a property that depreciates rapidly.

Conducting a robust due diligence process not only mitigates these risks but also enhances the investor’s ability to make strategic decisions. Each potential risk highlighted above underscores the necessity of thorough investigations, enabling investors to align their purchases with long-term objectives.

Impact of Due Diligence on Investment Decisions

The role of due diligence extends beyond mere risk assessment; it also significantly influences investment decisions and portfolio performance. A well-executed due diligence process can provide valuable insights that shape strategic directions.A thorough analysis might reveal opportunities for value addition, such as identifying properties that can be improved through renovations or better management. This insight can lead to increased rental income or appreciation in property value.

Conversely, due diligence might also identify properties that should be avoided due to high risk factors or unfavorable market conditions. Investors who embrace due diligence can create a more resilient portfolio by diversifying their investments based on solid data. For instance, those who analyze market trends can strategically invest in emerging neighborhoods, thereby boosting their portfolio’s potential returns.

“Investment success often hinges on the thoroughness of the due diligence process, as it lays the groundwork for informed decision-making.”

By understanding the implications of their findings, investors are better equipped to navigate the complexities of the real estate market, ultimately leading to enhanced portfolio performance and sustainable growth.

Key Components of a Due Diligence Checklist

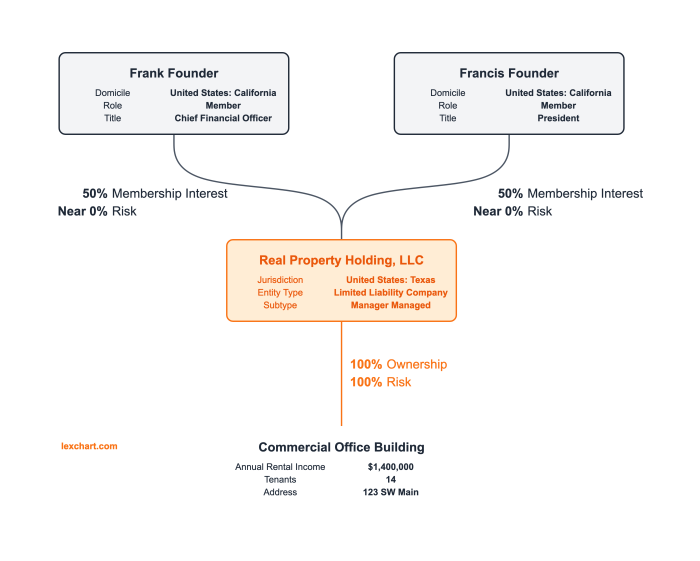

Source: adventuresincre.com

Conducting thorough due diligence is a cornerstone of successful real estate transactions. Having a comprehensive checklist helps to ensure that all critical aspects of the property are reviewed, minimizing risks and uncovering potential red flags that could affect the investment. This section breaks down the essential components of a due diligence checklist into three primary categories: legal, financial, and physical.

Legal Components

The legal aspects of a property are fundamental to ensuring that there are no unforeseen liabilities or disputes. This category includes a review of essential documents and legal obligations that affect the property.

| Component | Details | Examples |

|---|---|---|

| Title Search | Verification of the property’s ownership and any encumbrances. | Check for liens, easements, or claims against the property. |

| Zoning Compliance | Ensuring the property complies with local zoning laws and regulations. | Confirming the property can be used for intended purposes (e.g., residential, commercial). |

| Lease Agreements | Reviewing all current leases and rental agreements. | Checking for tenant rights, renewal clauses, and termination conditions. |

| Environmental Regulations | Investigation of environmental compliance and potential hazards. | Assessing if the property is in a flood zone or has hazardous materials on-site. |

Financial Components

Financial diligence is critical to understanding the potential return on investment and the overall viability of a property. This entails an assessment of both current and projected financial performance.

| Component | Details | Examples |

|---|---|---|

| Property Valuation | Determining the fair market value of the property. | Using comparative market analysis or appraisals. |

| Cash Flow Analysis | Reviewing income and expenses associated with the property. | Assessing rental income, maintenance costs, and property taxes. |

| Financing Options | Exploring various financing structures and loan options. | Understanding interest rates, terms, and lender requirements. |

| Investment Returns | Calculating potential ROI, cap rates, and cash-on-cash returns. | Estimating returns based on projected rental income and property appreciation. |

Physical Components

The physical inspection of a property can uncover issues that may not be immediately apparent but could lead to significant costs if left unaddressed.

| Component | Details | Examples |

|---|---|---|

| Building Inspection | Thorough examination of the property’s structure and systems. | Assessing the roof, HVAC systems, plumbing, and electrical systems. |

| Site Evaluation | Reviewing the physical site for potential issues. | Checking drainage, soil stability, and landscaping conditions. |

| Compliance with Building Codes | Ensuring the property meets all local construction codes and regulations. | Reviewing permits for any renovations or changes made to the property. |

| Environmental Assessments | Conducting studies for contamination or environmental hazards. | Phase 1 Environmental Site Assessment to identify potential issues. |

Legal Considerations in Due Diligence

The legal aspects of real estate due diligence are crucial in ensuring that a property transaction proceeds smoothly and without future legal entanglements. This phase involves thorough examination of various legal documents and compliance with applicable laws to protect the interests of the buyer and ensure that the property is free of any encumbrances.Reviewing legal documents is a foundational step in the due diligence process.

This includes examining contracts, leases, and any existing liens that may affect the property. Additionally, understanding the zoning regulations and performing title searches can prevent costly surprises down the road. A comprehensive legal review not only safeguards financial investments but also enhances the overall integrity of the transaction.

Legal Documents to Review

It is vital to conduct a thorough review of key legal documents during the real estate due diligence process. Each document can reveal important information about ownership, liabilities, and compliance with local regulations.

- Title Deed: Confirms ownership and any claims on the property.

- Purchase Agreement: Details terms and conditions of the sale.

- Lease Agreements: Reviews existing tenant obligations and rights.

- Property Tax Records: Ensures all taxes are paid and assesses future liabilities.

- Environmental Assessments: Identifies potential environmental issues affecting the property.

- Surveys: Provides accurate boundaries and any encroachments.

- CC&Rs (Covenants, Conditions, and Restrictions): Artikels limitations on property use.

- Pending Litigation: Reviews any ongoing legal disputes involving the property.

Importance of Title Searches and Zoning Regulations

Conducting title searches and understanding zoning regulations is vital for any real estate transaction. A title search identifies any legal claims against the property, such as liens or easements, that could hinder a buyer’s ownership rights. Failure to address these issues may lead to significant financial and legal repercussions in the future.Zoning regulations dictate how a property can be used and developed, impacting its potential value and usability.

Understanding these regulations can help buyers avoid properties that might not meet their intended use, ensuring that the investment aligns with their long-term goals.

Legal Due Diligence Checklist

To streamline the legal due diligence process, employing a checklist format can be beneficial. This allows for a systematic approach to reviewing all necessary legal aspects before finalizing a property transaction.

- Verify property ownership through the title deed.

- Check for existing liens or mortgages on the property.

- Review all lease agreements for terms and tenant obligations.

- Assess the current zoning classification and its implications.

- Examine property tax records for past due amounts and assessments.

- Conduct environmental assessments to identify any potential liabilities.

- Review site surveys for boundaries and easements.

- Investigate any pending litigation that could impact the property.

Financial Assessment Techniques

Evaluating the financial viability of a real estate investment is crucial for informed decision-making. Understanding how to assess various financial metrics can significantly impact investment outcomes and help mitigate risks.To effectively analyze the financial aspects of a real estate investment, it’s essential to focus on cash flow, return on investment (ROI), and financing options. Each of these components provides valuable insights into the potential profitability and sustainability of an investment.

Cash Flow Analysis

Cash flow is the net amount of cash being transferred into and out of an investment. It is vital to ensure that the property generates sufficient income to cover expenses and provide a return to investors. Key factors to consider in cash flow analysis include:

- Gross Rental Income: The total income generated from rental payments before any expenses are deducted.

- Operating Expenses: These include property management fees, maintenance, property taxes, insurance, and utilities.

- Net Operating Income (NOI): Calculated as Gross Rental Income minus Operating Expenses, it represents the income available to pay debts and provide returns.

- Cash Flow: NOI minus Debt Service (mortgage payments), reflecting the actual cash available to the investor each month.

Cash Flow = Net Operating Income – Debt Service

Return on Investment (ROI)

ROI measures the efficiency of an investment, indicating how much profit is made relative to the amount invested. Calculating ROI is essential for comparing different investment opportunities and making strategic decisions. The ROI formula can be represented as:

ROI = (Net Profit / Total Investment) x 100

Where:

- Net Profit = Total Income – Total Expenses

- Total Investment includes all costs associated with purchasing and owning the property.

A higher ROI indicates a more profitable investment. For instance, if a property generates a net profit of $20,000 and the total investment was $200,000, the ROI would be 10%.

Financing Options

Analyzing potential financing options is crucial for optimizing cash flow and ROI. Various financing methods can be utilized depending on the investor’s financial situation and investment strategy. Common financing options include:

- Conventional Mortgages: Standard loans provided by banks or credit unions, often requiring a down payment.

- Hard Money Loans: Short-term loans secured by real estate, typically offered by private investors or companies.

- Seller Financing: The property seller finances the purchase, allowing for more flexible terms and potentially lower interest rates.

- Partnerships: Joining forces with other investors to pool resources and share risks while accessing larger or multiple properties.

Comparison of Financial Metrics

The following table summarizes essential financial metrics and their significance in real estate investment analysis:

| Financial Metric | Description | Importance |

|---|---|---|

| Gross Rental Income | Total income from rent | Indicator of potential revenue |

| Net Operating Income (NOI) | Income after operating expenses | Measures profitability before debt |

| Cash Flow | Net cash available to investor | Critical for liquidity and sustainability |

| Return on Investment (ROI) | Percentage return on investment | Benchmark for investment efficiency |

| Debt Service Coverage Ratio (DSCR) | NOI divided by total debt service | Indicates ability to cover debt obligations |

Understanding and accurately assessing these financial metrics lays the groundwork for successful real estate investment decisions. By employing these financial assessment techniques, investors can enhance their strategy and ensure that their investments yield favorable returns.

Physical Inspection Procedures

Source: pikbest.com

Conducting physical inspections is a crucial step in the real estate due diligence process. It involves a thorough evaluation of the property to identify any potential issues that could affect its value or functionality. This stage helps buyers make informed decisions, ensuring they understand the true condition of the asset they are considering.Physical inspections encompass various steps designed to evaluate the overall condition of the property.

It is essential to focus on key areas such as structural integrity, major systems, and the overall condition of the property. By following a structured approach, potential issues can be identified early, allowing for proper negotiations or remedial actions.

Steps Involved in Conducting Physical Inspections

The physical inspection of a property should be methodical and comprehensive. Here is a checklist of key areas to inspect, which can serve as a guide:

- Exterior Inspection:

- Evaluate the condition of the roof, including shingles, flashing, and gutters.

- Inspect the foundation and look for signs of settling, cracking, or moisture issues.

- Review siding, windows, and doors for structural integrity and weatherproofing.

- Interior Inspection:

- Check walls, ceilings, and floors for signs of damage, mold, or moisture.

- Inspect plumbing systems for leaks, water pressure, and drainage issues.

- Examine electrical systems, including outlets, panels, and wiring for safety compliance.

- Mechanical Systems:

- Evaluate HVAC systems for functionality and maintenance history.

- Inspect water heaters and appliances for age and operational efficiency.

- Landscaping and Surroundings:

- Assess the condition of driveways, walkways, and any external structures (e.g., decks, fences).

- Evaluate drainage systems and landscaping for potential erosion or flooding issues.

- Safety and Compliance:

- Check for the presence of smoke and carbon monoxide detectors.

- Review local codes and zoning regulations for compliance issues.

By systematically inspecting these areas, inspectors can identify any critical repairs needed, which can influence the overall investment strategy. Remember, thorough inspections not only provide insight into immediate repairs but also project future maintenance costs, ensuring buyers are well-prepared for ownership responsibilities.

Environmental Considerations

In the realm of real estate due diligence, environmental assessments are critical to identify any potential risks that may arise from the property’s surroundings. Understanding the environmental implications not only safeguards the investment but also ensures compliance with local regulations and promotes sustainable practices.Environmental assessments consist of various procedures aimed at identifying, evaluating, and mitigating environmental hazards associated with a property.

These assessments help in determining the presence of contaminants or environmentally sensitive areas that could affect the property’s value or usability.

Environmental Assessments Required During Due Diligence

A thorough environmental assessment usually includes multiple steps and checks. The following structured list illustrates the key components involved in conducting these assessments:

- Phase I Environmental Site Assessment (ESA): This initial assessment involves a review of historical property use and environmental records to identify potential contamination sources. It typically includes site visits and interviews with past owners or tenants.

- Phase II ESA: If Phase I indicates potential hazards, a Phase II ESA entails soil, water, and air sampling to test for contamination levels. This phase confirms the presence and extent of any pollutants.

- Compliance with Environmental Regulations: Ensure the property adheres to local, state, and federal environmental laws. This includes checking for necessary permits and previous violations.

- Asbestos and Lead Paint Inspections: For properties built before specific years, conducting tests for hazardous materials such as asbestos and lead paint is vital to ensure safety and compliance.

- Wetland Delineation: Identifying and mapping any wetland areas is important, as development activities in these zones may require special permits.

- Radon Testing: Testing for radon levels, particularly in basements and enclosed spaces, is crucial due to the health risks associated with prolonged exposure.

Identification of Potential Environmental Hazards

Identifying potential environmental hazards involves a systematic approach. Key actions include conducting detailed property inspections and reviewing historical land use records. This helps in recognizing risks such as contamination from neighboring facilities, proximity to landfills, or evidence of illegal dumping.A vital aspect of this identification process is to check for the following potential hazards:

- Soil Contamination: Look for signs of chemical spills or waste disposal that may have impacted the soil.

- Water Quality Issues: Assess nearby water bodies for pollutants, which could affect groundwater sources.

- Air Quality Concerns: Evaluate any industrial activities in the vicinity that contribute to air pollution.

- Wildlife and Habitat Disruption: Investigate whether the property affects local ecosystems, particularly with the presence of endangered species.

Environmental Compliance Checks

Conducting environmental compliance checks is essential for ensuring that the property adheres to all relevant environmental regulations. These checks play a vital role in mitigating risks and preventing future liabilities. The following compliance checks should be performed:

- Verification of Environmental Permits: Confirm that any operational permits related to waste management or emissions are current and compliant.

- Review of Past Environmental Assessments: Examine previous assessments for any unresolved issues or required follow-up actions.

- Monitoring of Environmental Performance: Assess ongoing compliance with environmental standards through performance records or audits.

- Mitigation Strategies for Identified Hazards: Ensure that there are established plans for addressing any identified environmental risks.

Market Analysis

Source: template.net

Conducting a thorough market analysis is a pivotal step in the real estate due diligence process. This analysis provides insights into the viability and potential profitability of a property, allowing investors and buyers to make informed decisions. Understanding the market landscape not only sheds light on the immediate surroundings of the property but also highlights broader economic factors that could influence its value.A comprehensive market analysis involves examining various factors including location, competition, and current market trends.

These elements help in assessing the demand and supply dynamics of a specific real estate market, ultimately influencing pricing strategies and investment outcomes.

Techniques for Performing Market Analysis, Real Estate Due Diligence Checklist

Utilizing effective techniques for market analysis can significantly enhance the accuracy of your evaluations. Key factors to consider include:

- Location Analysis: Evaluate the property’s proximity to essential amenities, transportation hubs, and employment centers. Areas with good schools, parks, and shopping facilities typically command higher property values.

- Competitive Analysis: Identify and analyze similar properties in the area. Look into their pricing, features, and occupancy rates to understand competitive positioning.

- Market Trends: Monitor broader economic indicators such as employment rates, population growth, and housing supply. Trends can indicate rising or falling property values.

- Sales Data: Collect data on recent sales of comparable properties (comps) to establish a fair market value. This includes sale prices, time on the market, and buyer demographics.

A well-structured market analysis report can be invaluable for presenting your findings. Below is an example format of how this report might look using an HTML table layout:

| Property Type | Location | Price | Days on Market | Buyer Profile |

|---|---|---|---|---|

| Single Family Home | Downtown | $450,000 | 30 | Young Families |

| Condo | Uptown | $350,000 | 45 | Young Professionals |

| Multi-family Unit | Suburbs | $600,000 | 20 | Investors |

By employing these techniques and organizing your findings in a structured manner, you will enhance the clarity and effectiveness of your market analysis. This approach not only aids in making strategic decisions but also provides a compelling narrative that can reassure stakeholders of the property’s investment potential.

Finalizing the Due Diligence Process

Finalizing the due diligence process is a critical step that ensures all gathered data is accurate, comprehensive, and appropriately analyzed for decision-making. This stage can significantly impact the success of your real estate transaction, whether you’re negotiating deals or preparing for acquisition. Here, we’ll Artikel the steps to wrap up the due diligence process and provide a structured approach to compiling your findings.

Steps to Finalize Due Diligence

After collecting the necessary information, it’s essential to follow a systematic approach to finalize your due diligence. This includes verifying data, assessing risks, and preparing for negotiations. The steps below will guide you through this process:

1. Data Verification

Double-check all collected documents and information to confirm their accuracy. This includes title reports, property surveys, and financial statements. Any discrepancies should be resolved before proceeding.

2. Risk Assessment

Evaluate potential risks identified during your due diligence. Consider how these may affect the deal’s feasibility or future performance. This analysis should include financial risks, market conditions, and physical property issues.

3. Financial Analysis

Compile financial information to assess the property’s value and potential returns. This involves creating projections based on gathered data and considering all costs associated with the property.

4. Drafting a Due Diligence Report

Prepare a comprehensive report that summarizes your findings, including any issues that may require attention. This document should be clear and concise, making it easy for stakeholders to understand the key points.

5. Preparation for Negotiations

Using your report, develop a negotiation strategy. Identify your leverage points based on your findings, and determine your position on price, terms, and conditions.

6. Final Review and Approval

Before finalizing the process, conduct a thorough review of the due diligence report and proposed negotiation tactics with your team or stakeholders to ensure consensus and alignment.

Summary Checklist of Final Due Diligence Tasks

To avoid overlooking any critical tasks, a summary checklist can be a helpful tool in the finalization process. Below are key items to include in your checklist:

- Verify all property-related documents (title, surveys, financials).

- Assess risks and their potential impact on the transaction.

- Compile financial projections and analyze return on investment.

- Draft a clear due diligence report summarizing findings.

- Strategize negotiation points based on due diligence insights.

- Conduct a final review with stakeholders before concluding the process.

“Thorough due diligence is not just about checking boxes; it’s about ensuring informed decisions that safeguard your investment.”

Finalizing the due diligence process effectively reduces the likelihood of surprises after the transaction and lays the groundwork for successful negotiations or acquisitions. Taking the time to carefully compile and analyze all findings will contribute significantly to making informed and confident investment decisions.

Conclusive Thoughts

In conclusion, the Real Estate Due Diligence Checklist serves as a vital tool for anyone involved in real estate transactions. By methodically evaluating each aspect Artikeld in this guide, you’ll not only protect your investment but also empower yourself to engage more effectively in negotiations and acquisitions. Remember, thorough due diligence is the key to unlocking successful real estate ventures.

Question Bank: Real Estate Due Diligence Checklist

What is the purpose of a due diligence checklist?

A due diligence checklist helps ensure all necessary evaluations and assessments are completed before finalizing a real estate transaction, minimizing risks.

How long does the due diligence process take?

The duration of the due diligence process can vary, typically ranging from a few days to several weeks, depending on the complexity of the property.

Who should conduct the due diligence?

Ideally, a team of professionals, including real estate agents, lawyers, and inspectors, should conduct due diligence to cover all necessary aspects.

What happens if due diligence reveals issues?

If issues are found during due diligence, buyers can negotiate repairs, adjust the purchase price, or, in some cases, back out of the deal.

Is due diligence required for all real estate transactions?

While not legally required, conducting due diligence is highly recommended for all real estate transactions to protect against unforeseen problems.